Award-winning PDF software

Form 9423 ND: What You Should Know

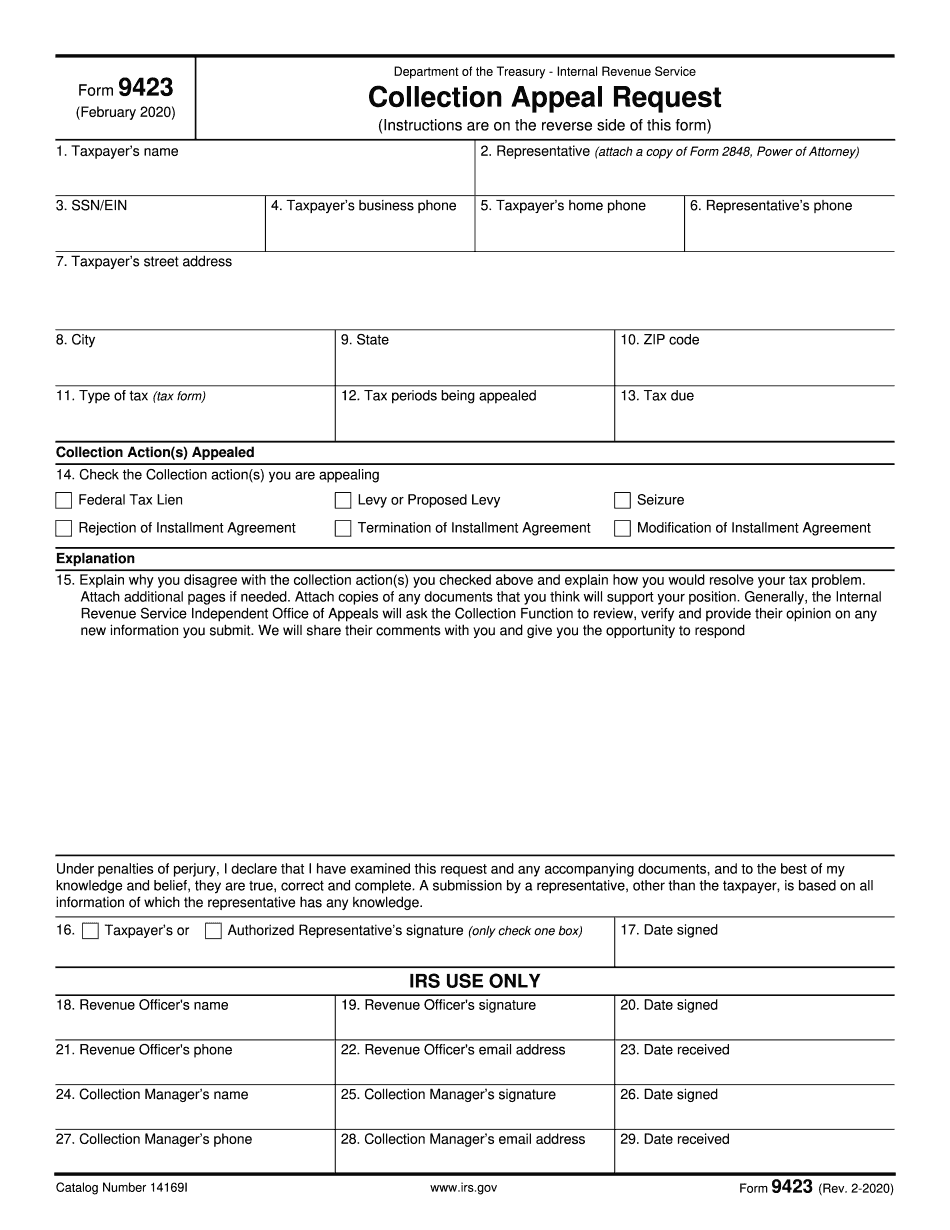

If the appeal is successful, the IRS may agree to amend the original collection if the terms described in the appeal agreement with the taxpayer are not met by the collector. The IRS collection in question may not be the same one that originally triggered the collection action against you. For example, the first collector to contact you may have sent a tax lien letter or notification to the tax department where your business currently holds property. The second collector may have been a second taxpayer. There are many ways to start the appeal process. You should be able to use the forms listed below as a starting point. The following are the details of your options: Appeal from the decision, order or final decision of a court or United States Tax Court based on the same facts and circumstances that made the original collection action brought against you. Appeal from a decision, order or final decision of the Commissioner of Internal Revenue or the Commissioner of the State Department of Internal Revenue (IRS) (if the collection was initiated by the Commissioner of Internal Revenue, see IR-2810). Appeal from a decision or order of a Federal Tax Department that determined the tax due you exceed the amount of the tax withheld by the collector and the collection agency. Any federal court decision or certified court order of the IRS (if you have a court order, see IR-2810) Appeal from a decision of the Internal Revenue Service Office of Appeals for the district where the collection was commenced (the district where the administrative law judge found error). The appeal must be filed within one year (180 days) from the date that the decision was handed down. This will be the last collection action that can be appealed under this provision. There are two types of cases that may be eligible for the relief of modified collection: Proved collection action was brought after the date the collection was commenced. Proved collection action wasn't brought after the date the collection action was commenced because in the collection, the collector misrepresented the facts related to those facts that made the collection action initiated. If the collector misrepresented the facts related to the facts that caused the initial action, you will not be able to initiate a modification appeal. However, if you did not make the initial action, you can attempt to obtain modified collection through the collection procedures outlined below. There are other types of appeals covered by this portion of the program that are specific to certain collection actions.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 9423 ND, keep away from glitches and furnish it inside a timely method:

How to complete a Form 9423 ND?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 9423 ND aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 9423 ND from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.