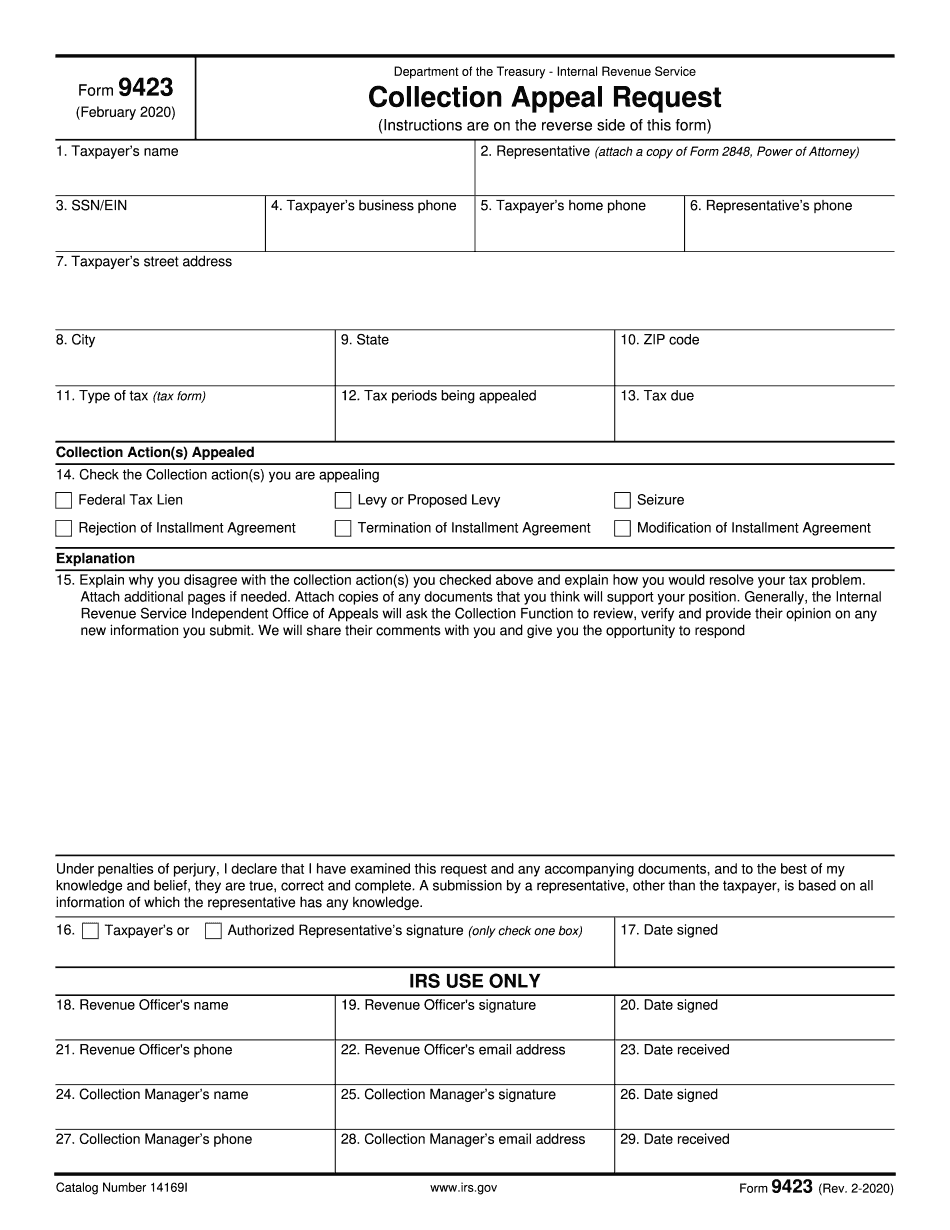

In this video we'll go over IRS form 9423 collection appeal request this is a simple document the form itself is one page long and then there are instructions for this form on the second page so probably a couple of things before we get into the form itself uh when would you file IRS form 9423 well if you are subject to the IRS collection appeals program so that's the acronym is Cap then anytime there's an action that's being taken or if you've applied for something like a removal of a tax lien something like that anytime you propose something that is rejected you'll usually find that the re rejection or the disapproval notification comes with instructions on filing form 9423 so and hopefully when the IRS starts the collections process you're in a position to either set up an installment agreement or make payments to reduce your tax liability but if at any point along the way there's a hiccup and the IRS is inclined to take the next step then you can file an appeal request which will temporarily pause the next collection action so for example a notice of federal tax lien uh that that has been or will be filed normally you know once that's been filed then there's the next step in the collections process but if you file a collection appeal requests then it has to stop until the IRS has a chance to go through and either approve or deny your collection appeal request so the examples on the form instructions of when you may be able to appeal a collection action if a levy or seizure action has been taken or is about to be taken if you've received a notice of a federal tax lien that either has been...

Award-winning PDF software

How to prepare Form 9423

About Form 9423

Form 9423 is the Collection Appeal Request, which is used by taxpayers who have been notified of a tax debt and want to challenge the IRSs collection activities. The form must be completed and submitted by the taxpayer within 30 days of receiving a Notice of Intent to Levy or other collection notice from the IRS. Those who have been subjected to inappropriate or unjust collection action by the IRS can use this form.

What Is 9423 Form?

Online technologies allow you to organize your document management and boost the efficiency of the workflow. Follow the short guideline to be able to fill out Irs 9423 Form?, stay away from mistakes and furnish it in a timely manner:

How to complete a how to file an appeal for irs tax?

- On the website containing the document, choose Start Now and go towards the editor.

- Use the clues to complete the relevant fields.

- Include your personal details and contact data.

- Make certain that you enter suitable data and numbers in proper fields.

- Carefully review the data in the blank as well as grammar and spelling.

- Refer to Help section should you have any questions or address our Support team.

- Put an digital signature on your Form 9423 printable using the help of Sign Tool.

- Once the form is finished, press Done.

- Distribute the prepared form by using electronic mail or fax, print it out or download on your gadget.

PDF editor enables you to make adjustments in your Form 9423 Fill Online from any internet linked gadget, customize it based on your needs, sign it electronically and distribute in different approaches.

What people say about us

How you can submit templates without mistakes

Video instructions and help with filling out and completing Form 9423