Award-winning PDF software

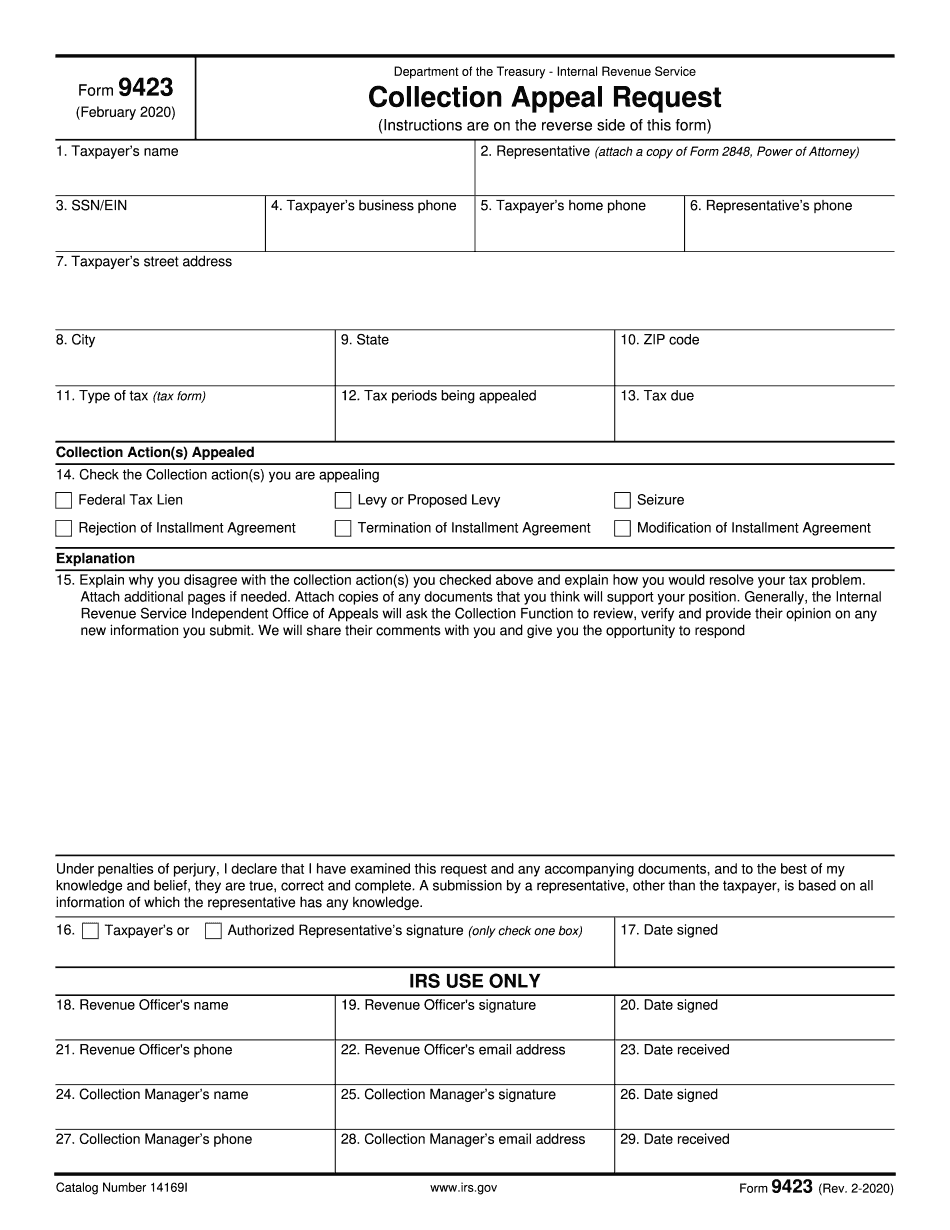

Printable Form 9423 Wisconsin: What You Should Know

You can also submit a certified statement of the form that you are appealing If you do not get an acknowledgment from the Collection office in the mail, write in and attach any supporting documents such as a certified letter from a physician or an application stating or explaining your disagreement. Also contact the agency that you are appealing and explain your disagreement. See also #4. If the agency refuses to acknowledge that the IRS has reviewed your case and determined that the amount of the penalty was the correct amount for the offense you are appealing, the IRS cannot resubmit or review your appeal. If the agency does not resubmit the appeal to the Office of Appeals by an appeal deadline, the IRS will review any new evidence that may be introduced into the record and will resubmit or review your appeal. If you do not agree with the decision of the Creditor (Tax Court), you can ask the Tax Court of Appeal to review the decision. In addition to this, you can request that the Tax Court of Appeals hold off on the determination of your civil penalty. See #1 in the next paragraph. You can also ask for an appeal of the decision made by the court. If you can't find an appellate court, you may have to try on your own. Your case should be filed in the appropriate district court (i.e., circuit court, county court, court of appeals, etc.) where you are employed or a member of your immediate family resides. For more information, see IRS Publication 501 under the heading “Find your Area”. If your claim is denied, and you are able to show the IRS wrongfully withheld the amount you owed, you have certain rights which you should be aware of before you file your claim. There are two types of appeals: (1) appeals from the decisions of the court to the IRS; (2) appeals from the decisions of the agency to the court. Appeals of the IRS to the Appeals Service: You can seek reconsideration of your tax liability. Under the Notice of Federal Tax Lien (Form 1042-S) you can request the IRS to review the amount you have borrowed to finance the tax liability. You can also appeal the determination of your tax return. The Appeals Service issues decisions in a timely manner, but a good filing-period before the Appeals Service can respond to your appeal is important.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 9423 Wisconsin, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 9423 Wisconsin?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 9423 Wisconsin aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 9423 Wisconsin from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.