Award-winning PDF software

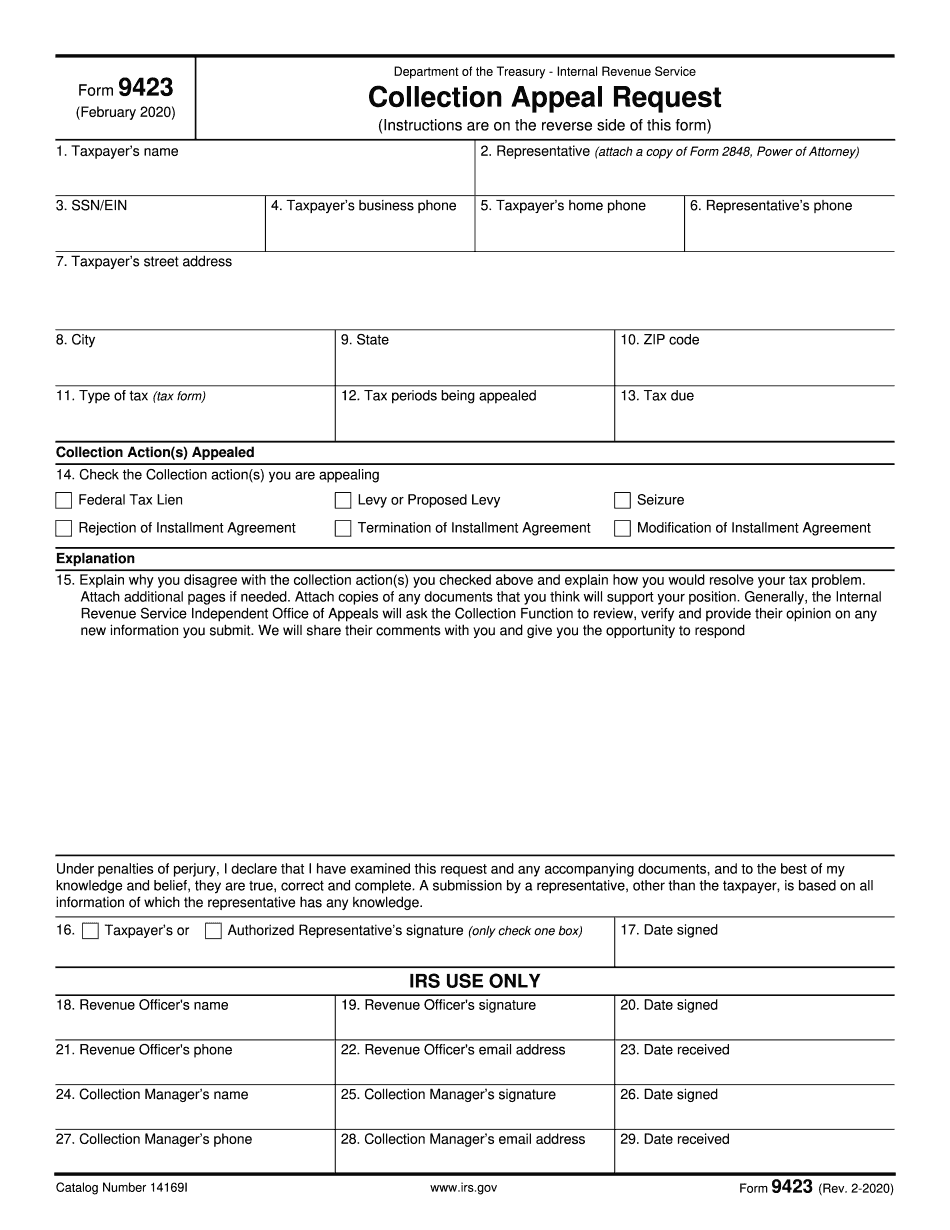

ID Form 9423: What You Should Know

Form 9423 should be ready in 1-2 minutes after. Go to the IRS website, sign in to your account, sign in to your desktop or laptop, and then click on the link to download. How to Use Form 9423 to Appeal IRS Lien, levy or seizure. How the IRS Collection Appeals Program works. This information explains everything you need to know about the IRS form 9423, Collection Appeal Request, as well as the procedures you must follow with regard to preparing & submitting the form. This information is also available by phone, calling. We also provide instructions for free online PDF submission. If the tax debt is not paid, you can apply for relief, including: Reverting to the status quo before the alleged tax debt arose. (This is called “reversal”) Excess Collection Case amounts (ACC). Relief for additional charges such as attorney fees, or any other civil action. If you do not apply for relief, you will have lost the ability to file for tax forgiveness. In other words, you are forever obligated to pay all the taxes you owe if you want to avoid paying more in taxes in the future. In the event that you get a Notice of Lien, Levy, Seizure, Suspension of Collection Proceeds or a Notice of Nonpayment (not a Notice of Lien, Levy, Seizure, Suspension of Collection Proceeds) from the IRS, your tax debts are forgiven. To learn more on your rights and responsibilities, you may want to start with our webinar entitled What Happens If You Get a Note of Lien or Levy or You Don't Pay Your Taxes?, which is part of the collection debt relief webinar package. The process begins with a Notice of Lien, Levy, Seizure, Suspension of Collection Proceeds — IRS. Your First Payment If you receive a Notice of Lien, Levy, Seizure, Suspension of Collection Proceeds, you may need to make your first payment. You may need to make your first payment on several IRS tax forms. This is necessary to get a check for your actual tax due or for your interest and penalty due, if any, plus you must also get the balance of your tax debt discharged.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete ID Form 9423, keep away from glitches and furnish it inside a timely method:

How to complete a ID Form 9423?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your ID Form 9423 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your ID Form 9423 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.