Award-winning PDF software

Form 9423 for New Jersey: What You Should Know

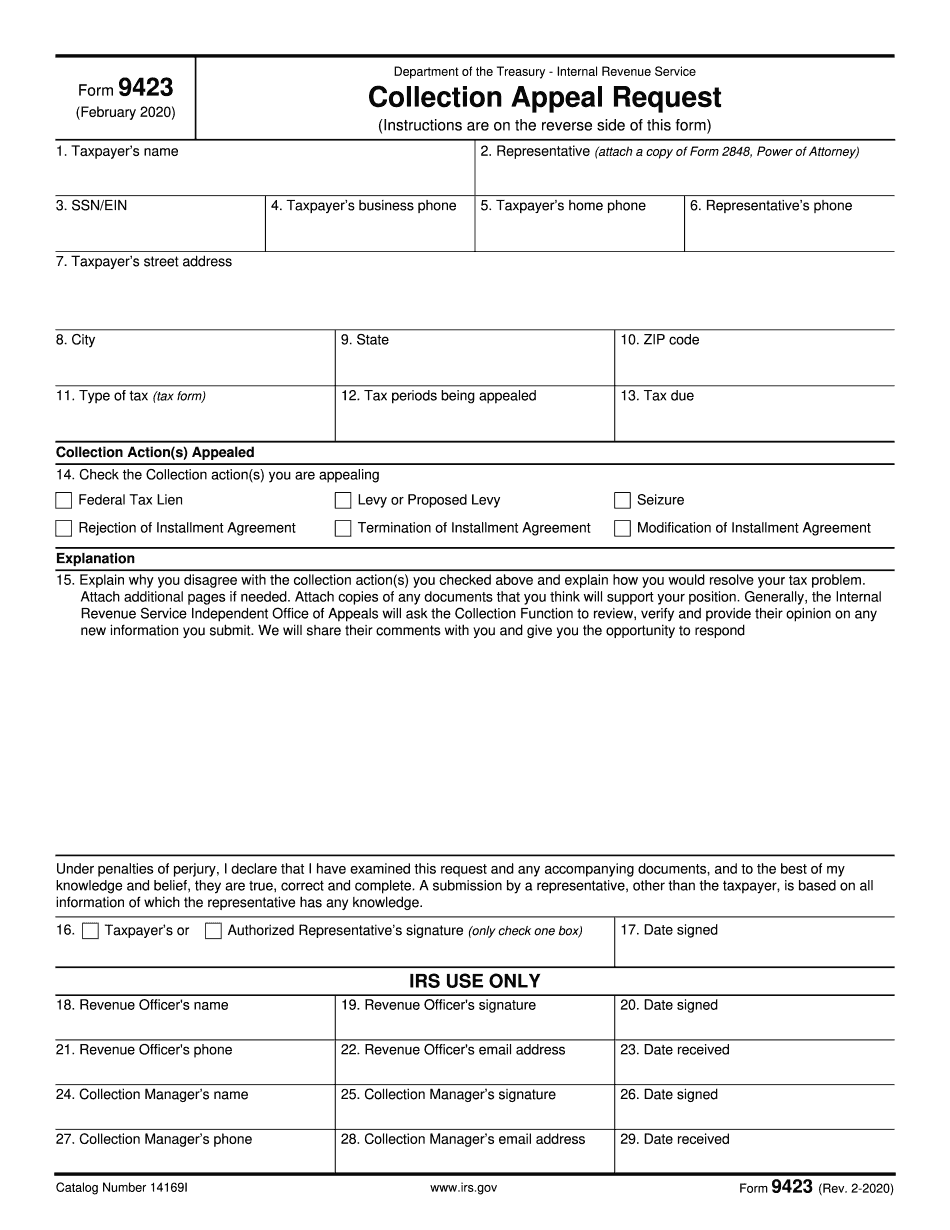

Both systems allow for a person to file a claim, be heard by an administrative law judge, and even request a hearing before a judge — in addition to the time limitations, penalties, and interest that apply to appeals filed by the IRS. The appeals procedures under the Internal Revenue Code (IRC) can be complex, but the process is very clear and understandable for taxpayers. Please see the section entitled “How you can file an appeal” at the bottom of the page for more information. Please note: The IRS will have no response to your appeal of an IRS tax deficiency or assessment. What do I need to file an IRS appeal? You can file an appeal form for any IRS tax deficiency on your return. The following documents will be used to file any appeals available for the calendar year: Unused Forms and Publications: In December 2018, the IRS sent a letter to taxpayers that if you were not given a return due date or expected a return by a certain date, and you did not file an appeal, you will lose your right to file a tax appeal for the prior tax year. If you have a question about how to file an appeal, please check out our Tax Topic Center for answers. What documents do I need to file an appeal? A copy of the taxpayer's tax return, along with a copy of the IRS notice of deficiency, Notice of Audit, Notice of deficiency adjustment, or Notice of Federal Tax Lien for the tax due This appeal form must be in .pdf format If you are using the new IRS Appeals Program, your form9423.pdf file needs to be on the following file types: How much should I file, and when should I file it? For information on filing taxes as a homemaker and small business owner, contact a local CPA. The information below is for the calendar year, 2018. In 2018, you should be able to expect to file your annual tax return in February 2017. The IRS will determine where your appeal will be heard. How long will it take to file an appeal or appeal? After you file your tax return by April 15 of the following tax year you will have up to 21 days to appeal the result. Your appeal is processed within 5 days of when the decision is made. You should be able to file your appeal (and your payment) within 21 business days of your filing date.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 9423 for New Jersey, keep away from glitches and furnish it inside a timely method:

How to complete a Form 9423 for New Jersey?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 9423 for New Jersey aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 9423 for New Jersey from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.