Hi, my name is David Bradley. I'm a CPA in Dallas, Texas, and I am the IRS doctor. 95 percent of my practice deals with people who have IRS issues, both individuals and businesses that require immediate action. Two of the big issues we often encounter with new clients are bank levies and wage garnishments. When the IRS reaches this point, it usually means that the taxpayer or the company has not appropriately responded to the IRS or failed to follow through on their commitments. As a result, the IRS resorts to levying bank accounts and wages. When someone comes to us with a wage garnishment, it is like DEFCON five, and we need to act quickly to lift the wage levy. There is a specific IRS code that addresses five areas in which a levy release is warranted, which we will discuss later. Are you currently affected by a bank levy or a wage garnishment? A wage garnishment is an ongoing matter where the IRS continuously takes a portion of your paycheck until the employer is notified to stop sending it to the IRS. On the other hand, a bank levy is a one-time event. For example, if you had $100 in your account on Thursday and a bank levy was imposed, the IRS can only secure that $100. The bank is required to hold it for 21 days to allow you to dispute the levy and seek resolution. However, there are fees associated with bank levies, ranging from $250 to $350, charged by the bank. If your paycheck is deposited the following Friday, the IRS is not entitled to that money. A bank levy only applies for the specific day it is imposed, and the IRS can only take the balance up to the amount of the levy. If...

Award-winning PDF software

9423 fax number Form: What You Should Know

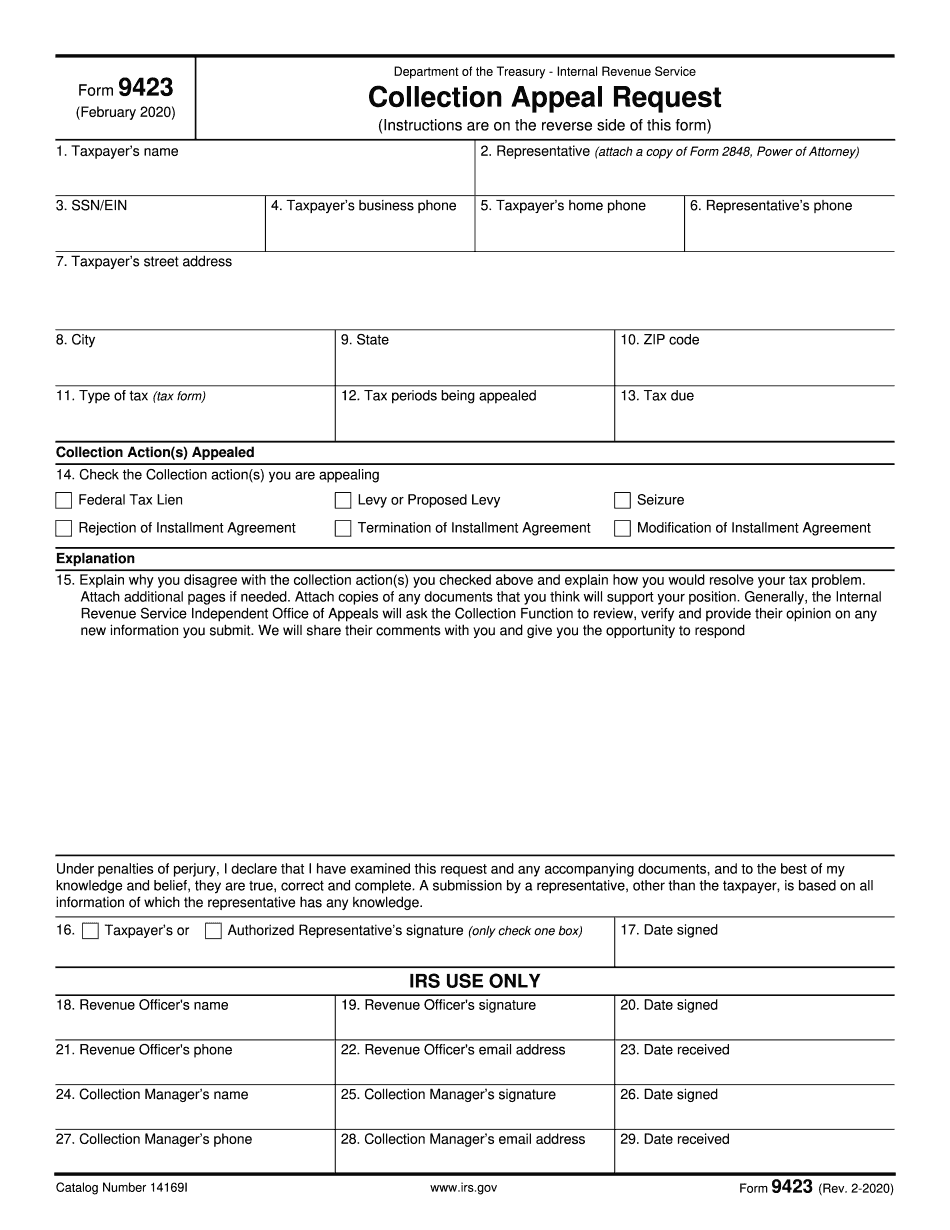

When you submit a request for hearing, you will be directed to the Appeals division. If you are not sure which division to contact, call the Appeals' office for the specific number listed on the notice and ask the person to which that refers. If there is no such person, call the Telephone Customer Service number listed on the notice and ask for the person you are looking for. If your request for appeal is not completed and received by the Collection Division within 10 calendar days of the date that you received a message, it will be considered completed, and you will have to submit new information to request additional appeals. Appeals Request — Form 9423 — IRS If your request for hearing is completed, submitted in a timely manner and received by the Collection Division in a timely manner the Office of the Chief Counsel may approve your request for hearing and determine your right to pursue an appeal to the Circuit Court of Appeals or the United States Supreme Court. You may not appeal the Collection Appeals Division's decision unless you are appealing a final administrative decision. For information on how to appeal a final administrative decision, see: The Department of the Treasury's Circular 230 Publication. The Circular 230 contains information about the rules, regulations, and other procedures for collecting certain fees, including interest. A copy of this publication may be obtained from the Office of the Chief Counsel, Revenue Operations at. Form 9423: Collection Appeals (CAP) The idea behind Form 9423 is as an opportunity to halt (and modify) an IRS collection that is currently in process. Therefore, the IRS Guide to IRS Collection Appeals Program (CAP) & Form 9423 If, however, your case has been assigned to the Collections division, you must first contact them using the number listed on the official notice that you received when you were informed of the assessment. When you submit a request for appealing, you will be directed to the Appeals division. If you are not sure which division to contact, call the Appeals' office for the specific number listed on the notice and ask the person you are looking for.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 9423, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 9423 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 9423 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 9423 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 9423 fax number