Award-winning PDF software

9423 PDF Form: What You Should Know

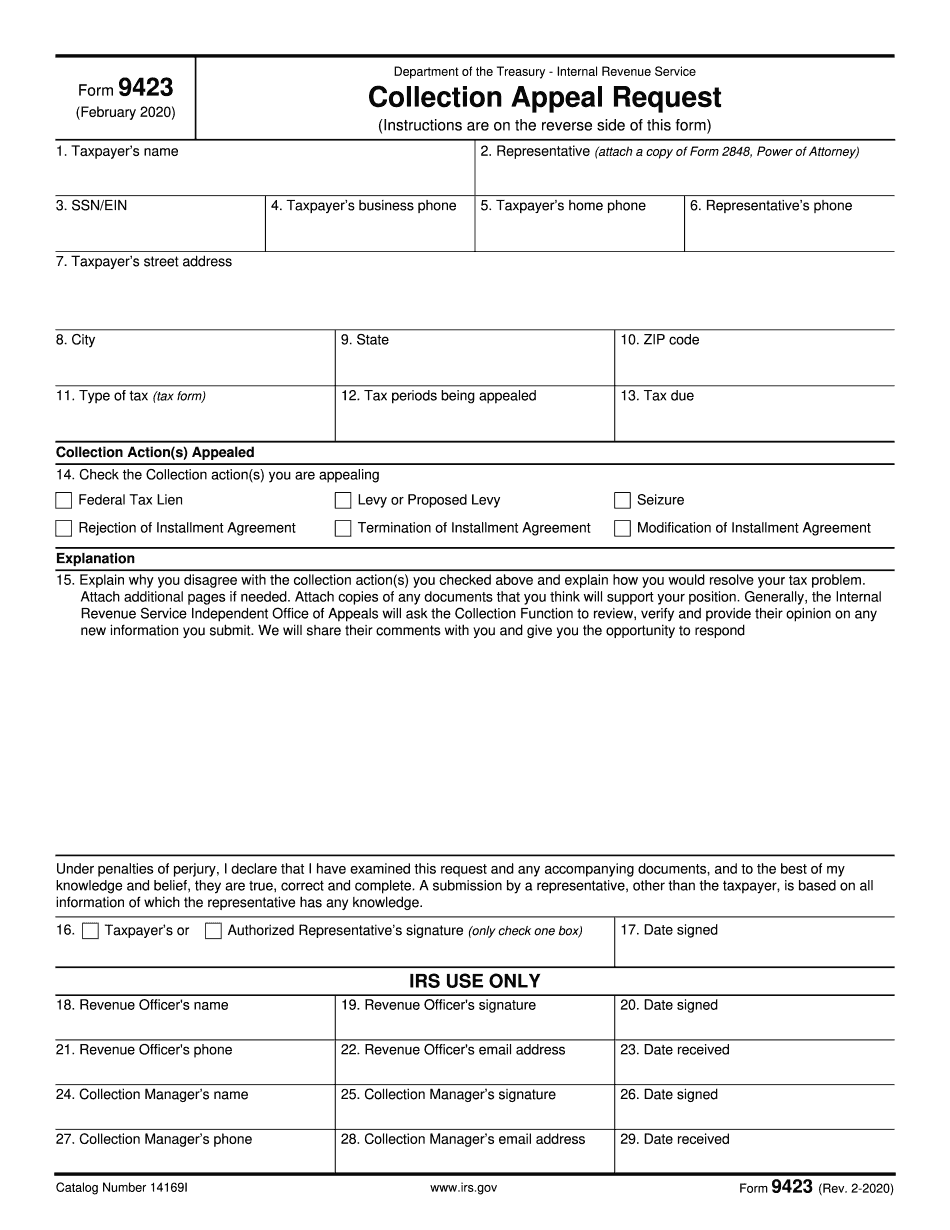

Fill a standard 990 or 1040 form, including income taxes, social security taxes of the person for whom your appeal is made. There is no wage limit for filing an appeal. You can use this form for appeal requests about Social Security payments, wage garnishment, tax liens, and other collection actions against your wages or other income. How to Appeal a Final Wage Garnishment from the Government. Why File an appeal? An appeal allows you the chance to explain your side of the story. A hearing of the Appeal Board will determine whether you have the right to appeal your wages to the United States District Court. The appeal process can only be completed when you have made (see below) your last due date under the collection agreement. An appeal also grants you the right to request an immediate review or reconsideration of any final decision involving the payment of your wages or other income. A wage garnishment that has already been imposed may be reversed if the worker files a voluntary appeal of the final order of the federal government. An appeal takes about two weeks. You may need to file and serve your appeal notice if the appeal date falls on a weekend or holiday. There is no wage limit to file an appeal. For your convenience, we have prepared forms for the following situations: · A payment is late. · An employee failed to complete a time and attendance record. You are required to file an annual return or timely pay any taxes and interest at the time of filing for individuals and joint return filing situations. Also, you must file Form 1040 and pay income taxes by April 15. But, your filing status is NOT to be suspended (which is required for wage garnishment) when you are filing your annual returns, if your total income is 200 or less; and your total wage is 15 or less per week for the period beginning on April 15, and ending on April 30. To help find the correct form for you, please use the following reference materials. IRS Form 944-S, Incomplete or Underpayments; Acknowledgment of Your Right to File An Appeal, must be completed in full. IRS Form 8871, Form 944-S; Underreporting Income to Avoid Wage Garnishment. Taxpayers should fill out the following form for an appeal: IRS Form 4023, Appeal, Federal Income Tax, for Individuals and Joint Returns: Appeal of the Following Actions.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 9423, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 9423 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 9423 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 9423 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.