All right, so let's go on. Now, we're going to start talking about an installment agreement. The context of the discussion here is emergency measures to stop collection. The single best way to do that is by filing a timely CDP request, as we have already discussed. However, you don't always have that luxury because it depends on when the client walks into your office and what stage of the procedure your client is in at that particular point in time. As I said, a lot of clients have blown their opportunity for a CDP hearing, so now you've got to try something else. One of the other very effective strategies, and I'll tell you this, is something that almost nobody knows about. Getting back to the question I answered a minute ago, when you read original source material, you discover things and learn things that most people don't know. This is important with respect to an installment agreement. Under the law, under the Internal Revenue Code, the application for an installment agreement stops enforced collection action. It operates as an injunction against the IRS from levying or seizing assets. So, this is a tool that you need to be aware of to help you stop collection action and negotiate with the IRS on behalf of your client. You need to use IRS form 9465 to do this. I shouldn't say "need" because any kind of application for an installment agreement will stop collection action if you put it in writing. If you call the IRS on the phone, which I don't recommend by the way, but I do like to use this form 9465 because it takes the confusion out of it. In the process of applying for an installment agreement, you're going to have to provide current financial...

Award-winning PDF software

Irs 9423 mailing address Form: What You Should Know

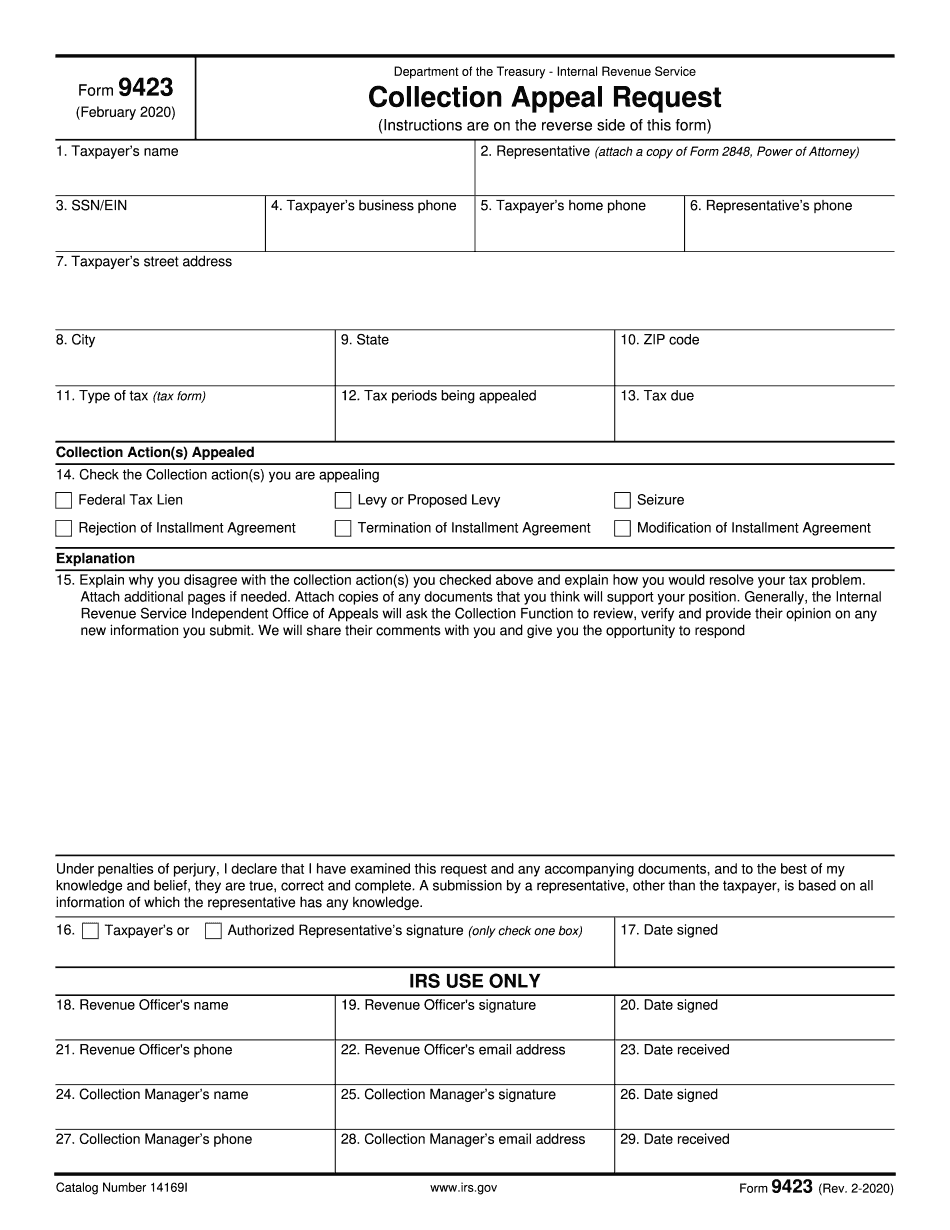

IRS Form 9423 is a procedure to request an appeal of a Notice of Federal Tax Lien, Notice of Levy, or Notice of Levy or Seizure. The IRS does not recommend filing Form 9423 to submit for a request to re- close the case. Your Taxpayer Services Representative (TSA) has advised you that due to the complexity of filing forms and submitting evidence for review under IRS review and appeal processes, it may take you longer to understand your appeals options during your current appeal cycle than if you were receiving taxpayer services, so you will see how to file these forms on your own schedule. In addition, your requests for services may come after IRS has posted this information on its website. If the IRS has not received Form 9423 within four (4) business days of your request, your request will be automatically re- filed using another form or process which is simpler and quicker for the process. In some cases, the IRS may notify you of changes in your case after you have filed your Form 9423. Where the IRS can give you a hard copy of Form 9423, see. Also see: • Please note: The IRS will not: • Deny a refund or adjust your refund; • Close or dismiss a case; • Reopen an appeal; • Require changes to the case plan (or other information); • Require any document be returned to you; • Require any fee be waived; • Require a court order be issued. If an IRS employee is responding to your appeal, please remain calm. There are two types of appeals cases: The case(s) listed above and: A dispute.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 9423, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 9423 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 9423 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 9423 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Irs Form 9423 mailing address