Award-winning PDF software

Printable Form 9423 Maine: What You Should Know

So I looked them up and was stunned! The state version of Form 1040: Income Tax Return 2025 is available now. If you're filing Maine taxes this year you'd better get busy. There are a lot of changes under that state's signature. You've got to start reviewing your deductions as you fill out your tax form 2018. I have recently seen this from a friend of mine in Florida, who has an EMI on her taxes! It appears the IRS wants to get its hands on a lot of her money. The IRS says that if you have this type of tax problem, send them your details, and they will send you a refund for the taxes owed that don't match what they say on your tax statement. The government's latest attempt at “over-collection” is a new law they're trying to push on small businesses. The IRS will now be sending “certification letters” to businesses for every 5,000 they fail to pay their taxes. It is an attempt at over-collection. It will take your account and ask you to “confirm” the correct amount owed. The “certification letter” will look identical to the “certification letter” you would get from the IRS. It's also your chance to tell them there is an error on your tax return. And that if you want to contest the error, you must use the IRS online dispute process. But the problem is they already know if you have a small business you'd have to start filing EFT returns. It is a bit frustrating to keep seeing the law making these types of things worse. That is exactly how I've seen it for the past 15 years. Now it is the IRS who is trying to over-collect. I know people, even people with a lot of money, get tricked into this type of over payment. There are people out there that want to be safe and stay away from fraud. I know a lot of people who are getting overcharged (in my business case), and a lot who are surprised to see they are overcharged. There are lots of great things that I did as a small business owner and this is one of them! If you want your small business to be more successful and have the ability to make a bigger profit, you will have to pay attention to these things.

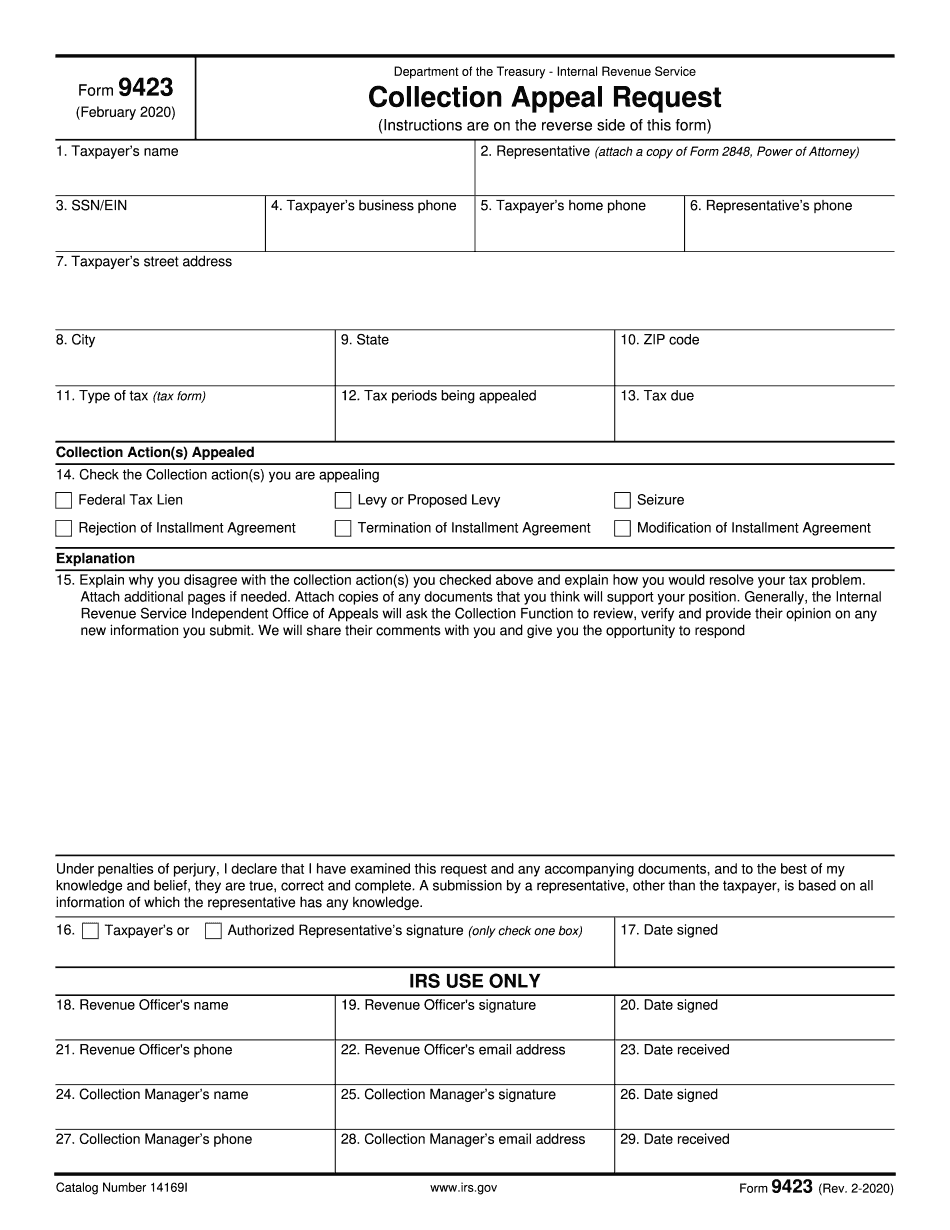

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 9423 Maine, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 9423 Maine?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 9423 Maine aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 9423 Maine from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.