Award-winning PDF software

Form 9423 online Washington: What You Should Know

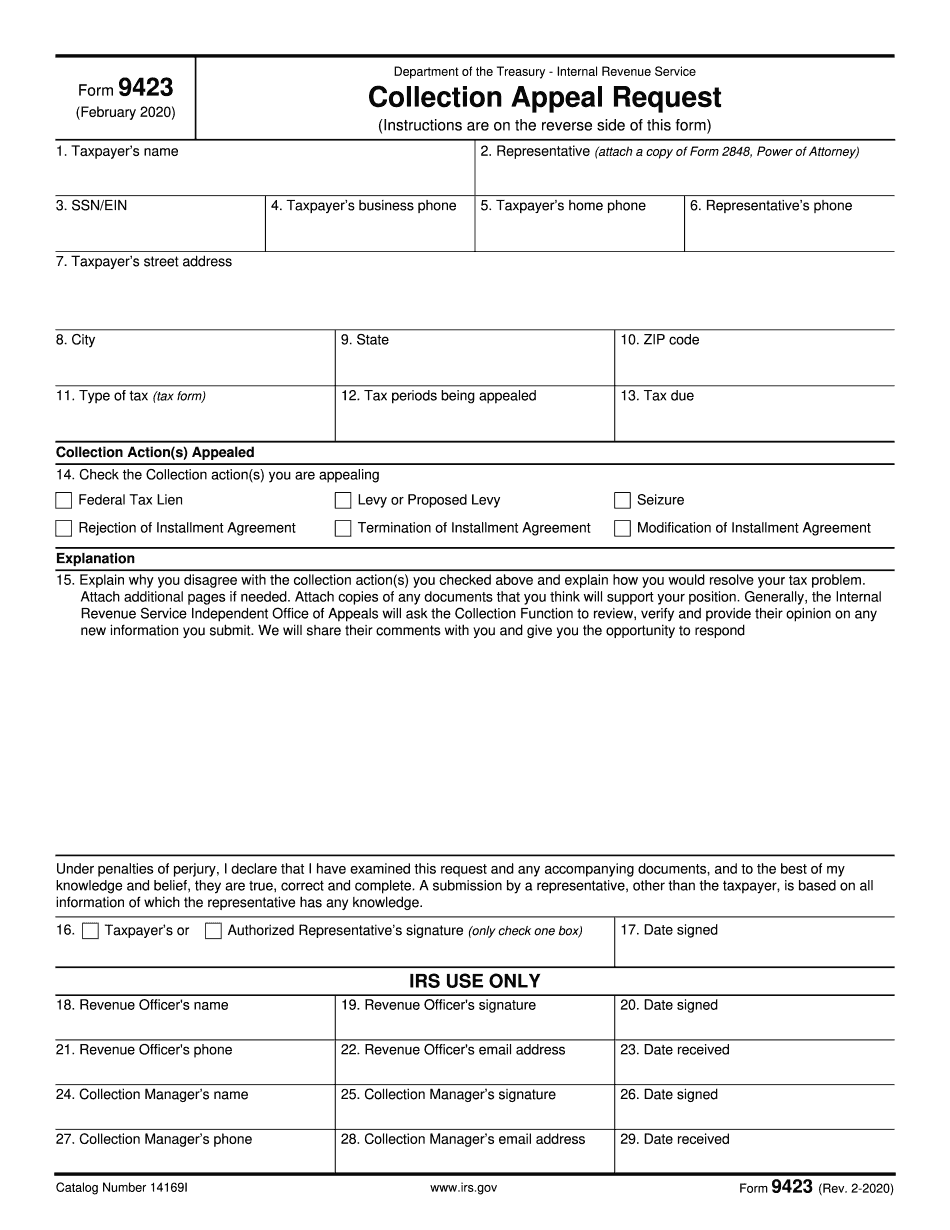

Notice of appeal to the Tax Court of the United States (OTC notice of appeal) — IRS Online (Electronic System for Tax Administration) No. 94-1924 (Jan 9, 1994), Notice to appeal in the Tax Court. This form is subject to the Electronic Filing requirements. Technical Details. The IRS Appeals System (IAS) is a facility that processes appeals against the decisions of the Administrative Law Judge (ALJ), the Department of Justice Tax Division. All decisions of the ALJ are posted on the IAS for review. Once a decision has been posted, a Tax Act determination is required to appeal. Forms 94-1925, 94-1926, and 94-1927 are used to access the IAS. When using these forms, be sure to follow all instructions before filing your claim. Notice to Applicant — IRS Notice of appeal — Tax Court of the United States (Electronic Filing) Form 9423, collection appeal request — Catalog — UW-Madison Pay a penalty on Form 8582 — IRS Form 8582, penalty imposed on failure to file a tax return, with Instructions and a penalty amount, Washington, D.C. : Dept. of the Treasury, Tax Division, Internet Information Center, Website, Physical Details. Note: If there are several of the same penalty for failure to file a return and penalty amounts are in amounts from different years, do not file an appeal on any one of those penalties at the same time. All penalty amounts must be filed according to the order of filing. Notice of appeal — IRS Online -Electronic System for Tax Administration Form 3400, Notice of Appeal, to appeal an adverse determination filed under section 2 of the Employee Retirement Income Security Act from the date of the initial determination to the date of a final decision with a refund or credit on any part of an earnings or interest payment that has resulted from a determination of undue hardship. Notice to Applicant — IRS Notice of appeal — OV-101 Form 3400, Notice of Appeal, to appeal an adverse determination made under section 536(a) of title 26 to the Commissioner of Social Security under section 20 of such Act. Technical Details. Notice to Applicant — IRS Online — Electronic System for Tax Administration Form 8959, Taxpayer Eligibility Verification Return, to deny tax-exempt status to an applicant who fails to provide documentary evidence to the taxpayer's request that he provide documentation required.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 9423 online Washington, keep away from glitches and furnish it inside a timely method:

How to complete a Form 9423 online Washington?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 9423 online Washington aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 9423 online Washington from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.