Award-winning PDF software

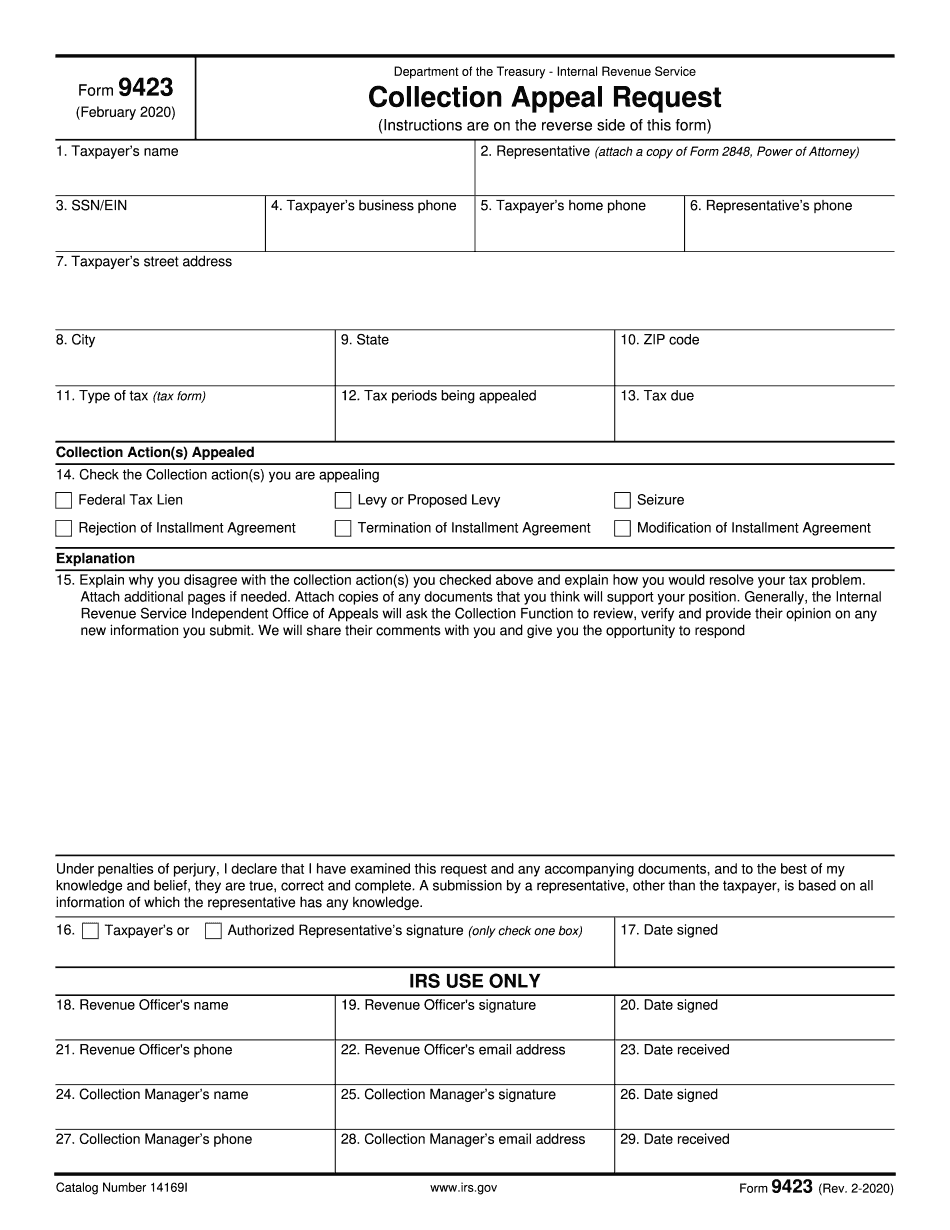

Ohio online Form 9423: What You Should Know

Note: This article was posted on November 22, 2016. New Mexico 1040C — CDP Form 12153 and Tax Return Form 8816 Use the New Mexico CDP Form 12153 to fill out tax return form 8816 for New Mexico. This form must be used, because it is the easiest way to fill out return forms for all three counties. Form 12153 is also used to fill out the 1040 and the 1040A after the IRS sues you for tax arbitrages and penalties. You can fill in forms that you have already filled out and mailed to the IRS for you. This will make it easier for you to fill out these forms when you need to. This is why most of these forms are often referred to as “preferred forms”. You can also fill out form 8816 to get tax information and the appropriate payment, but you should make sure it is the correct one for your county. Form 9430– Taxpayer's Rights to Appeal a Tax Bill — New Mexico Use the New Mexico tax form 9430 and the form 94-12 to appeal the amount due on a tax bill as well as the amount owed as a penalty for nonpayment of tax. The form 9430 also allows the taxpayer to request payment in full of the tax bill or collection fees. The form 9430 and 94-12 will only be used to appeal collections over the county level. It was passed in 2017, but did not go into effect until July 1, 2018. Form 5240 or Form 5960– Filing for IRS Appeals — New Mexico Use the New Mexico Form 5240 and the form 5960 to file a federal tax request. They are both for filing a tax appeal and request for more money to pay the IRS. Citations that Help You Find Your Country Here are some references to finding your country. United States: Find your country using the IRS Online Country Finder. Australia, Canada, and United Kingdom: Use the IRS Online Country Finder. Mexico: See the section below on your rights to dispute your tax information. New. Mexico: Find Your Country using the New Mexico Tax Form 9423. The form can be accessed using the New. Mexico IRS website. CDP: Find Your Country using The Collection Appeals Program (CAPS). The CASE uses Forms 122 to determine the correct county.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Ohio online Form 9423, keep away from glitches and furnish it inside a timely method:

How to complete a Ohio online Form 9423?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Ohio online Form 9423 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Ohio online Form 9423 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.