Award-winning PDF software

MI Form 9423: What You Should Know

You will also be able to better understand the information and questions you will answer with your tax professional. We hope to see every tax question answered in the FAQ section with all the answers you could possibly need. See what a qualified tax professional is all about. Appeal rights and benefits — Mass.gov Appeals rights and benefits. Read this information about how to file an appeal with the Massachusetts Department of Revenue. You will also see where you can find other resources for filing for an appeal. Appeals & penalties — Mass.gov More on Appeals, Penalties, and Interest. The appeals process can be complicated and can have significant impacts on your refund and tax return. You may need to file for a review of your appeal because the appeal panel can suspend, refuse, or reduce your refund for unsatisfactory information. If your appeal is denied, you may still have to pay a penalty. If allowed, the appeal can be appealed again to the Tax Court. The Appeals & Penalties page on Mass.gov contains more information about the Appeals Process, appeals and penalties. Appeal forms, instructions, and documents — Mass.gov A list of forms and instructions to follow when appealing an adverse tax decision or a loss or delay of penalty. The forms are for use by taxpayers in Massachusetts who have requested assistance in an unfavorable tax determination or appeal. The instructions are used in determining which form to use and for completing the form. Appeals and penalties — Mass.gov Information for tax professionals; a sample appeals letter to attach to your return; appeals and penalties rules for all IRS laws and regulations. Appeals and penalties — Mass.gov This page contains information about an appeal of U.S. tax income by the Commonwealth of Massachusetts against the tax obligation of an employee who holds the position for which the Commonwealth received the taxpayer's wages. It also contains information concerning appeals of U.S. tax assessments against Massachusetts employers and employees. Appeals and penalties — Mass.gov A list of Forms, publications, and websites dealing with the appeals process which you may find helpful. Application for review of an unfavorable assessment or deficiency — Mass.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete MI Form 9423, keep away from glitches and furnish it inside a timely method:

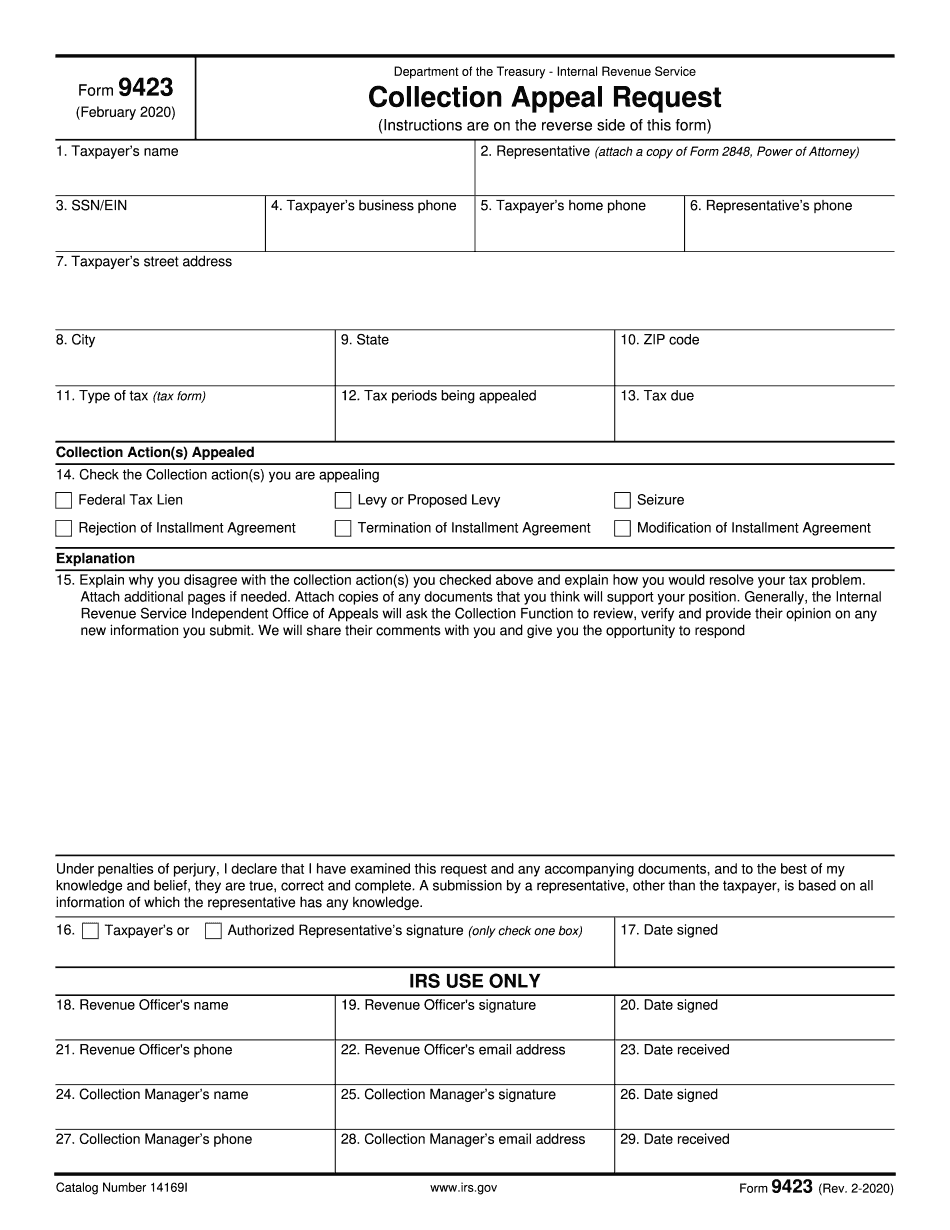

How to complete a MI Form 9423?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your MI Form 9423 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your MI Form 9423 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.