Award-winning PDF software

Form 9423 IN: What You Should Know

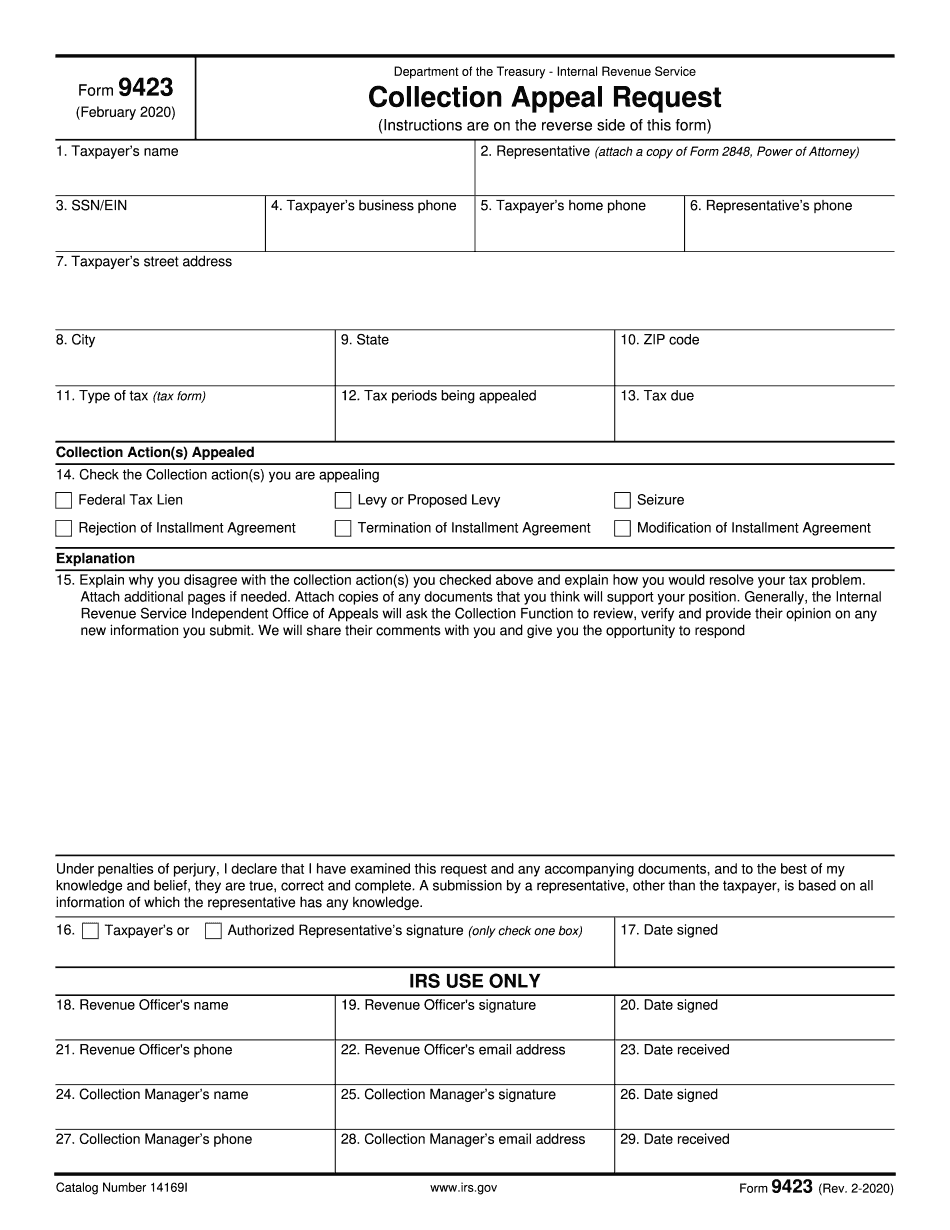

The collection appeal process is different for each type of collection appeal as follows: Collection appeal (tax): Request the IRS to provide an explanation of the amount(s) that is being claimed for any tax liability, interest, penalty, collection, or penalty Income Tax (CI): IRS needs to file an estimate (which does not include any tax for which the taxpayer is liable) Loan Collection Fund: IRS needs to complete and file an accurate Form 8918, LCD Information to establish the source(s) of funds and payment for the amount owed Other: Collection appeal should include a request for a hearing within the timeframe stated and the IRS must follow certain conditions (and provide an explanation) in order to be able to delay or revoke the collection Review these instructions carefully! Make sure your information is accurate, complete, and accurate and that the information you provide is sufficient. If there aren't any errors and if there is enough information to fill out the tax form 9423, you can complete it as long as your full name, address, and state is indicated. Be advised that the instructions are written by the IRS and the information may contain errors — please do your best to verify the information before submitting it! Taxpayer Assistance Centers (TAC) and the IRS have very limited contact information and contact information is the same for the TAC as for the IRS office in your area. Therefore, there are some common questions that the CRA will ask you. It's best to provide the most accurate information possible for the CRA (you can do this by providing a Form 9423) and to help them fill out one out. If you're not familiar with CRA calls, read about the call process first and then start answering them. For a detailed review of this form, click on the links below : If we don't have the info, it could mean your request is on hold or may not go anywhere. This is why it's important to remember what the form requires.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 9423 IN, keep away from glitches and furnish it inside a timely method:

How to complete a Form 9423 IN?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 9423 IN aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 9423 IN from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.