Award-winning PDF software

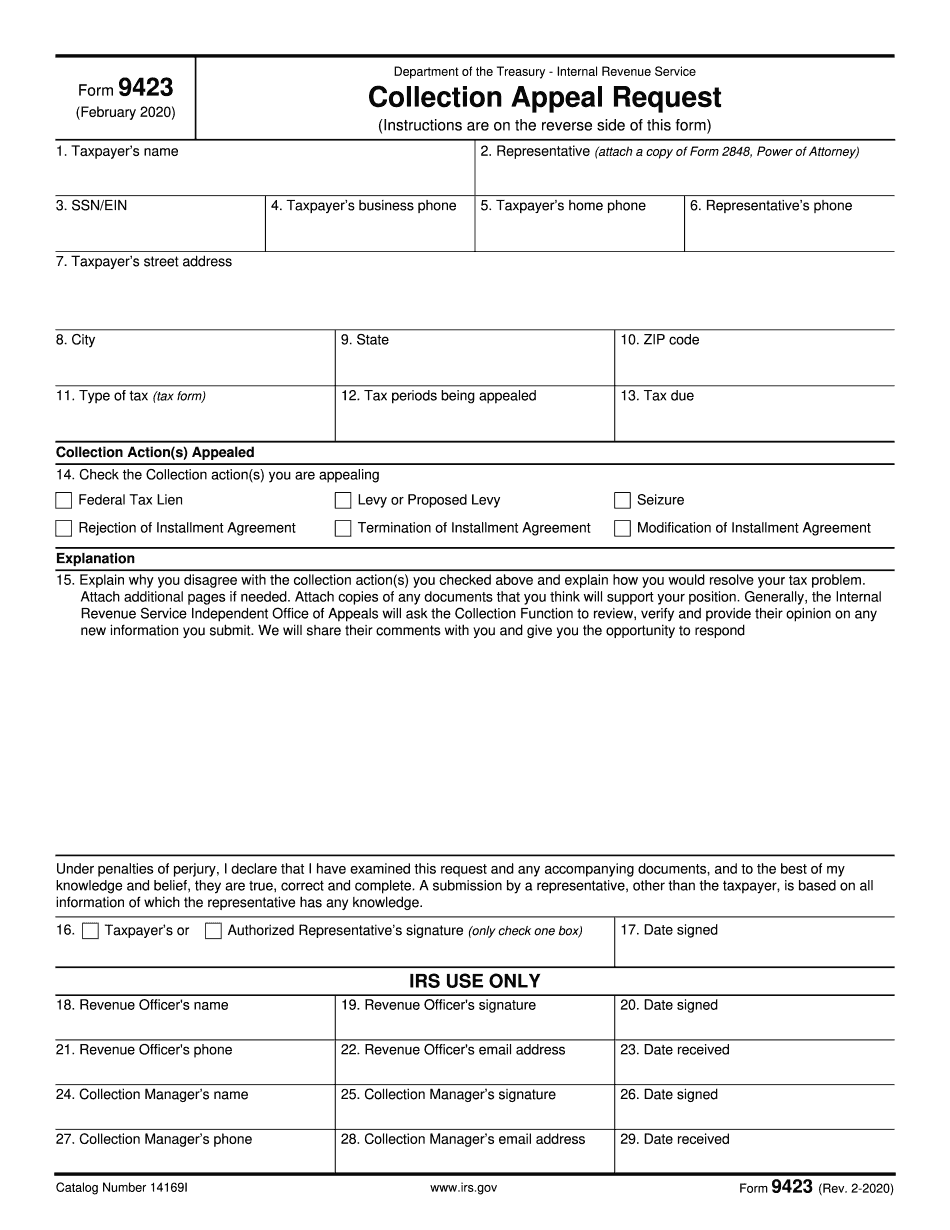

Printable Form 9423 Nassau New York: What You Should Know

Sole Proprietorship, Individuals, & CPA's I've recently made available these templates to help you file your taxes online in New York City. You'll need Word to edit these. For more instructions, visit the document templates page and take a tour. If you wish to file all the tax forms electronically, you MUST pay by mail. This has been confirmed for tax years 2025 through 2019. If you paid online you will need to enter that amount to file. These forms require a minimum credit of 1,500, but in my opinion the tax penalties are not worth the increased cost just to avoid a long delay while you wait for your refund. You can file your taxes online to ensure your refund within two weeks: If you had a home office, use your New York IRS tax return and apply your business expenses to your home office expenses from the New York Section 988 Business Expenses table. The amount listed on the line 7 of Form 1040, Schedule A, has been confirmed as the income from any non-taxable business. The amount of personal deductions allowed on line 14 of Form 1040, Schedule A, has not been confirmed. The total amount you have to pay on line 1 of Form 1040 and line 13 of Form 1040.2a are all the required sales tax. The amount of any sales tax can be found in the Section 901(i)(9), (j), (k), (l) or (m) line of Form 940. Make sure line 12 or 13 of Form 1040.2a is completed and that any penalties are fully included on line 11. If you are filing Form 8801, you must file it by a certain date (not sure). If you are not filing Form 8801 by the specified deadline, the IRS requires you to file your return before the following April 15. In most of my readers, you will already have the following forms filed and ready to go. In most cases, it's easiest to just print out the PDFs from your phone, and do not fill in any information. Please remember: you never know what the IRS is going to ask you to fill out or where they are emailing you.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 9423 Nassau New York, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 9423 Nassau New York?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 9423 Nassau New York aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 9423 Nassau New York from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.