Award-winning PDF software

Form 9423 Texas Collin: What You Should Know

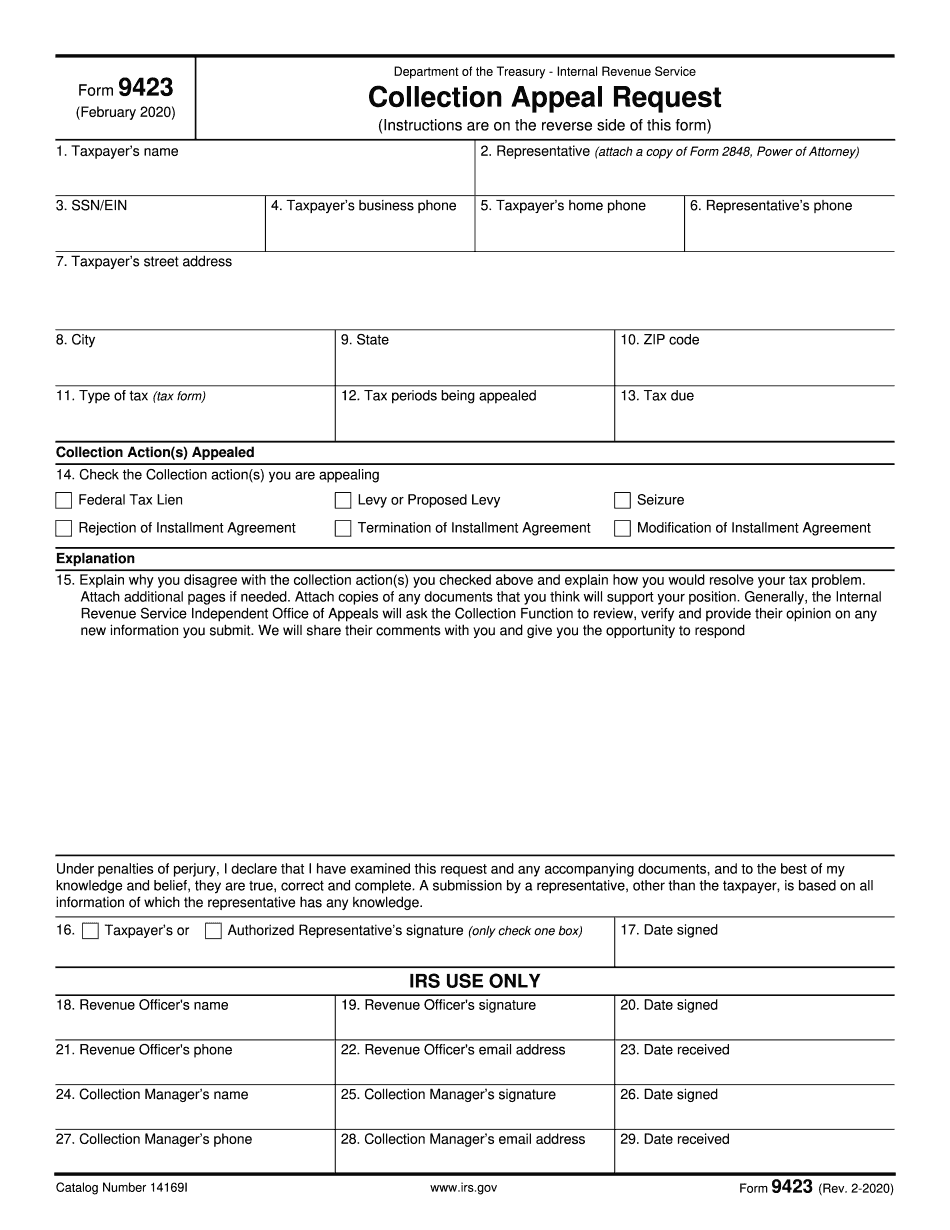

Form 4410, or a Notice of Federal Tax Lien (NFL). The notice of federal tax lien is provided to the taxpayer if a Notice of Federal Tax Lien is provided or an IRS Form 4410 has not yet been filed. A Form 4410 is given after a hearing at which both the taxpayer and the IRS may be heard. The IRS, after filing their Notice of Federal Tax Lien, also provides a Notice of Federal Tax Lien and the taxpayer also receives a final notice of federal tax lien. If, after a final notice of federal tax lien, the taxpayer is still interested in appeal(s) the toll may increase to 10 days without obtaining more information. Nov 12, 2025 — Changes In the Appeals Process CDP hearing procedures have changed in CDP hearings, a letter has been mailed to all CDP applicants. See the link below for how to comply. Dec 30, 2025 — Changes To Your Right To Appeal Your Federal Income Tax Liens — Federal Tax Regulations The IRS has issued new guidelines for the appeal process you have if you're facing an IRS tax lien. As of December 2016, the following changes take effect and you no longer have a right to appeal a tax lien, however, the IRS provides an appeal form, a hearing and an appeal court order. Dec 2, 2025 — IRS Announces “Agency-Wide Changes & Updates To Tax Pro Se Programs” The final version of the Tax Pro Se Handbook will be available to consumers on July 12, 2018. The release of this guide coincides with the completion of the fourth edition of the Tax Pro Se Guidebook that is more than three years in the making, was produced to comply with new guidelines issued by the Department of the Treasury's Office of Tax Policy (OTP). A copy of the Tax Pro Se Handbook will be available to consumers through January 31, 2019. The TaxProShelter Website and the IRS Tax Pro Se Blog has more information about the book. In the “Guidebook” section, you will find more information on the IRS and its tax programs and how they are being implemented across the agency. You will also find information on the Tax Pro Se programs that provide consumer education and assistance. The Tax Pro Se (Policies, Programs & Products) Website will be updated to reflect the changes in the Guidebook.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 9423 Texas Collin, keep away from glitches and furnish it inside a timely method:

How to complete a Form 9423 Texas Collin?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 9423 Texas Collin aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 9423 Texas Collin from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.