Award-winning PDF software

collection appeals program (cap) & form 9423 - taxcure

You can see examples of what this will look like here. Income Tax Notice 2000-53 What does this notice do? This notice has the IRS's instructions on how to prepare an appeal. The notice says: Please be advised that, until you have been notified of the proposed determination as a result of our appeals, you may not know the specific amount of the deficiency you are seeking to appeal. You must, however, advise us so that we will be in a position to prepare and send to you the notice of proposed determination as of the closing of our examination or by the date that the final settlement agreement or decision is made. If we decide to accept a payment in lieu of the proposed disposition, we will send you a Notice of Rejection of Payment. The Notice of Rejection of Payment is a letter acknowledging that the offer of settlement was refused and the.

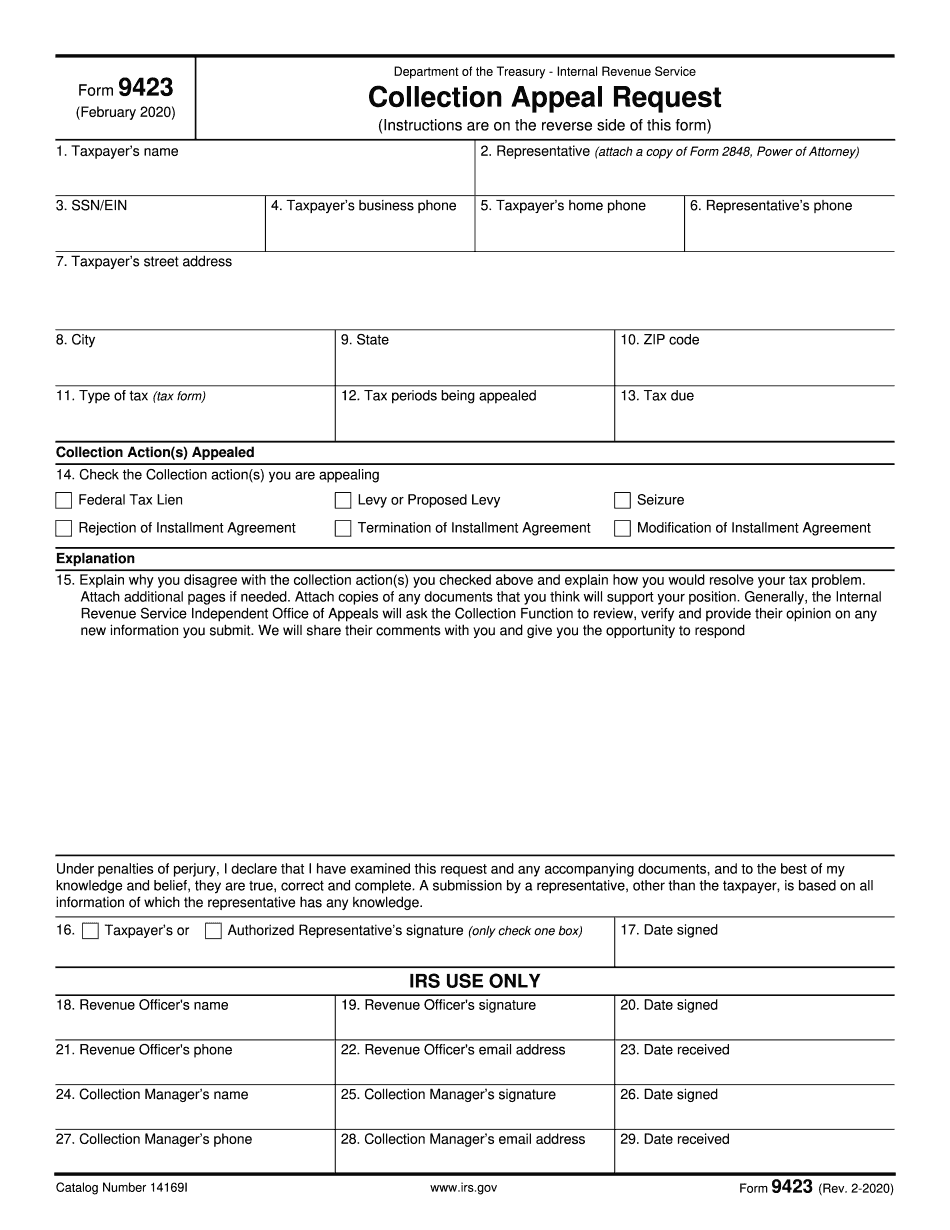

How to file form 9423 collection appeal request (cap)

This includes pursuing delinquent tax refunds, attempting collection, and taking other enforcement actions. The Department of Treasury issues and enforces an annual Notice of Deficiency against taxpayers on a delinquent return. Such letters may also state the taxpayer's proposed assessment of penalties and interest. The Government can also pursue civil enforcement actions for tax deficiency on behalf of the IRS, such as collection and/or filing of a lawsuit. For further information, please see the Notice of Deficiency and the Notice Regarding Collection of Taxes (IRS Pub 612). Criminal Investigation As a general rule, if you feel you may be a victim of identity theft, you should report your identity theft to the appropriate authorities. In some cases, you may be able to report the incidents to the IRS at The IRS works with government and businesses across the country through Operation ID to help prevent and detect identity theft. In addition, the IRS.

- form 9423 fill online, printable, fillable

The Form 9423 can be found at our link: The IRS has not responded to my requests.

Description: form 9423, collection appeal request - falvey

IRS WITHDRAWALS: A LOOK BACK FOR THE RECORD: THE RULING THAT WASHINGTON IS A RETURNING TAX CIRCLE. The IRS is a returning taxpayer. Our Tax Court is not. We are on the move. This is not my opinion. It is the IRS' own public record. I cite the IRS' own Internal Revenue Ruling on its own. This is the IRS' own view. And this is the law. This is as close as you will find. And when they talk about not paying attention to the “old rules,” they are correct. As a “returning taxpayer,” you are legally obligated to provide adequate documentation to the IRS on each of the five years you have been a taxpayer. (The six months of documentation after the tax year for which the return was filed were the same. No need to ask for them back.) And if you claim to have paid no taxes in the IRS'.

Fillable form 9423 | edit, sign & download in pdf | pdfrun

Your taxes as a Federal Taxpayer Your failure to file your taxes. An itemization of non-reported income as a Federal Taxpayer which is not claimed on your tax return (Form 8968) The fact that you never received a tax refund because of an overpayment of tax. The number of returns filed for a calendar year and the number of returns not filed. Your failure to report and pay over the earned foreign income tax credits. Failure to return any earnings to the United States in connection with tax, tax haven taxes. If you believe your tax situation has changed and that the Internal Revenue Service is not dealing with this timely or in a timely manner, you may be entitled to file an Internal Revenue Service Form 9423. The Collection Appeal Request (CARR) form is available through your financial aid office at certain times, and you can find it under the Student Accounts program. What can I.