Facing an IRS audit elicits both fear and dread for most people. Keep watching to learn more about appealing an IRS audit and what steps you need to take going forward. There are a few reasons you might face an audit. First, the IRS does do statistical random audits. You might have been chosen by the computer. You might also have an error in your tax filing that made the IRS take a closer look. You might have some numbers that don't add up or make sense. If you make a large number of deductions or use tax credits, there might be something the IRS doesn't agree with. The auditing process: your audit could happen via mail exchange or with an in-person interview. The IRS in-person interviews could be at your home, office, lawyer's office, or an IRS office. If you've been told your audit will be by mail, the IRS is likely to request more information and records which you can submit to them. If you have too much paperwork to submit, you can always request an in-person interview. Appealing an audit: So, you've received a notification your audit is complete. The IRS will send you a detailed breakdown of the proposed assessments and changes they propose & proposed changes in interest, penalties, and taxes. It may surprise you to hear, the first thing to do, despite it being what the IRS wants you to do, is to not sign the appeal form. When you don't sign it and 30 days pass, then the IRS generates a 30-day letter that explains how to appeal the audit results. You'll be asked to write a formal appeal letter. The letter should contain a series of information related to your appeal. The IRS has a form, IRS Form 12203-A, that you'll need to complete that requests an appeal for the audit...

Award-winning PDF software

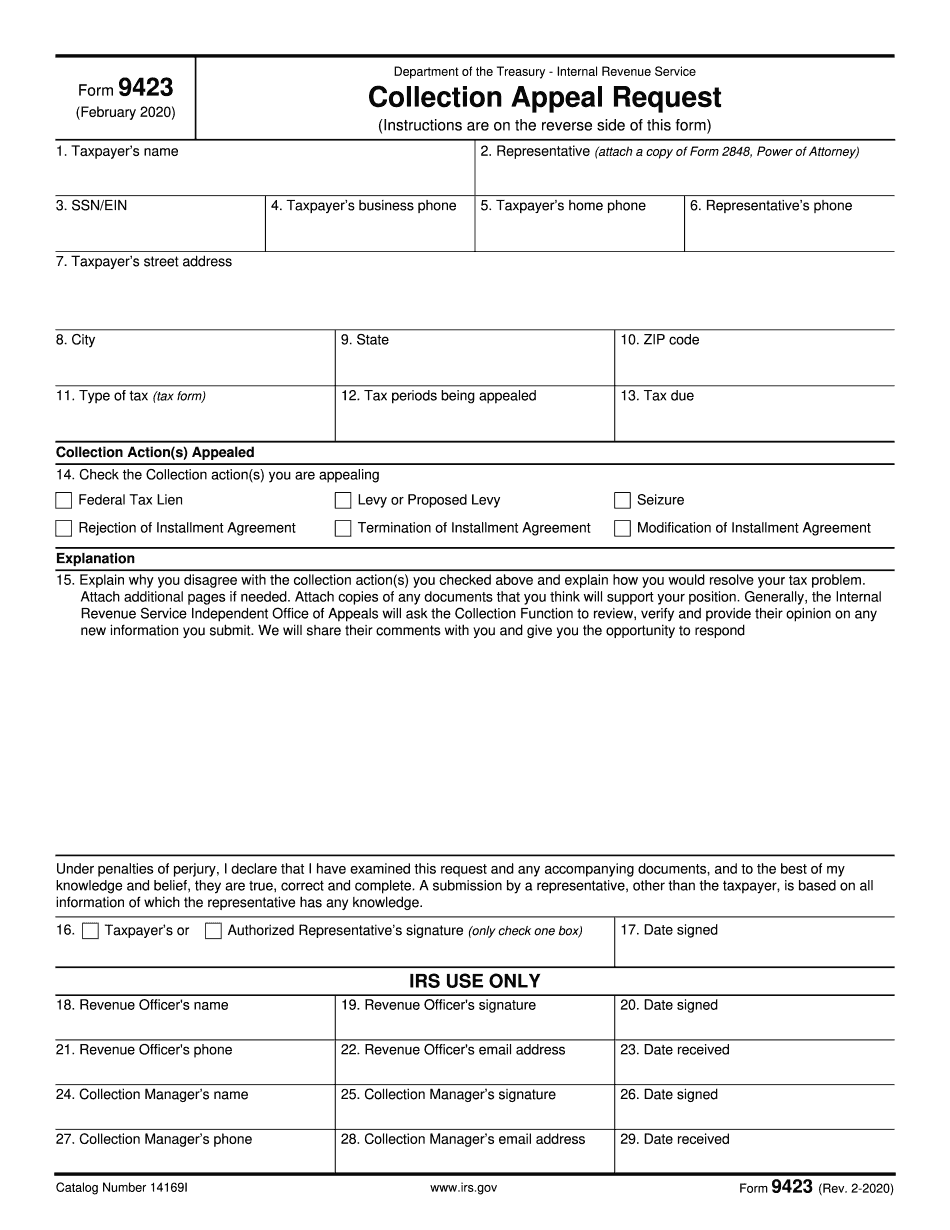

4 Steps To An Irs Collection Appeal - Form 9423 - Silver Tax: What You Should Know

Collection Appeal to Department of Justice. For additional information on the IRS Appeals process, contact the IRS Appeals office at. You can also contact us online. Note: The IRS must accept, on a “best effort” basis, all requests for appeal made within 120 days of the final determination. Taxpayers with Questions — Internal Revenue Service The U.S. Treasury Inspector General for Tax Administration's (TI GTA) Taxpayer Advocate Service has also released a fact sheet on IRS appeals process.

Online methods enable you to to arrange your document administration and strengthen the productivity within your workflow. Observe the fast manual as a way to comprehensive 4 Steps To An IRS Collection Appeal - Form 9423 - Silver Tax, keep clear of problems and furnish it in the well timed fashion:

How to accomplish a 4 Steps To An IRS Collection Appeal - Form 9423 - Silver Tax on-line:

- On the web site with all the variety, click Get started Now and pass into the editor.

- Use the clues to fill out the relevant fields.

- Include your personal information and get in touch with details.

- Make certain you enter appropriate information and quantities in ideal fields.

- Carefully take a look at the material of your kind at the same time as grammar and spelling.

- Refer to help section for people with any inquiries or handle our Aid workforce.

- Put an electronic signature on your own 4 Steps To An IRS Collection Appeal - Form 9423 - Silver Tax along with the guidance of Signal Software.

- Once the form is finished, press Done.

- Distribute the completely ready form by way of email or fax, print it out or conserve on your own device.

PDF editor enables you to make changes towards your 4 Steps To An IRS Collection Appeal - Form 9423 - Silver Tax from any online related device, personalize it in accordance with your preferences, indication it electronically and distribute in various options.

Video instructions and help with filling out and completing 4 Steps To An Irs Collection Appeal - Form 9423 - Silver Tax