Award-winning PDF software

Guide To Irs Collection Appeals Program (Cap) & Form 9423: What You Should Know

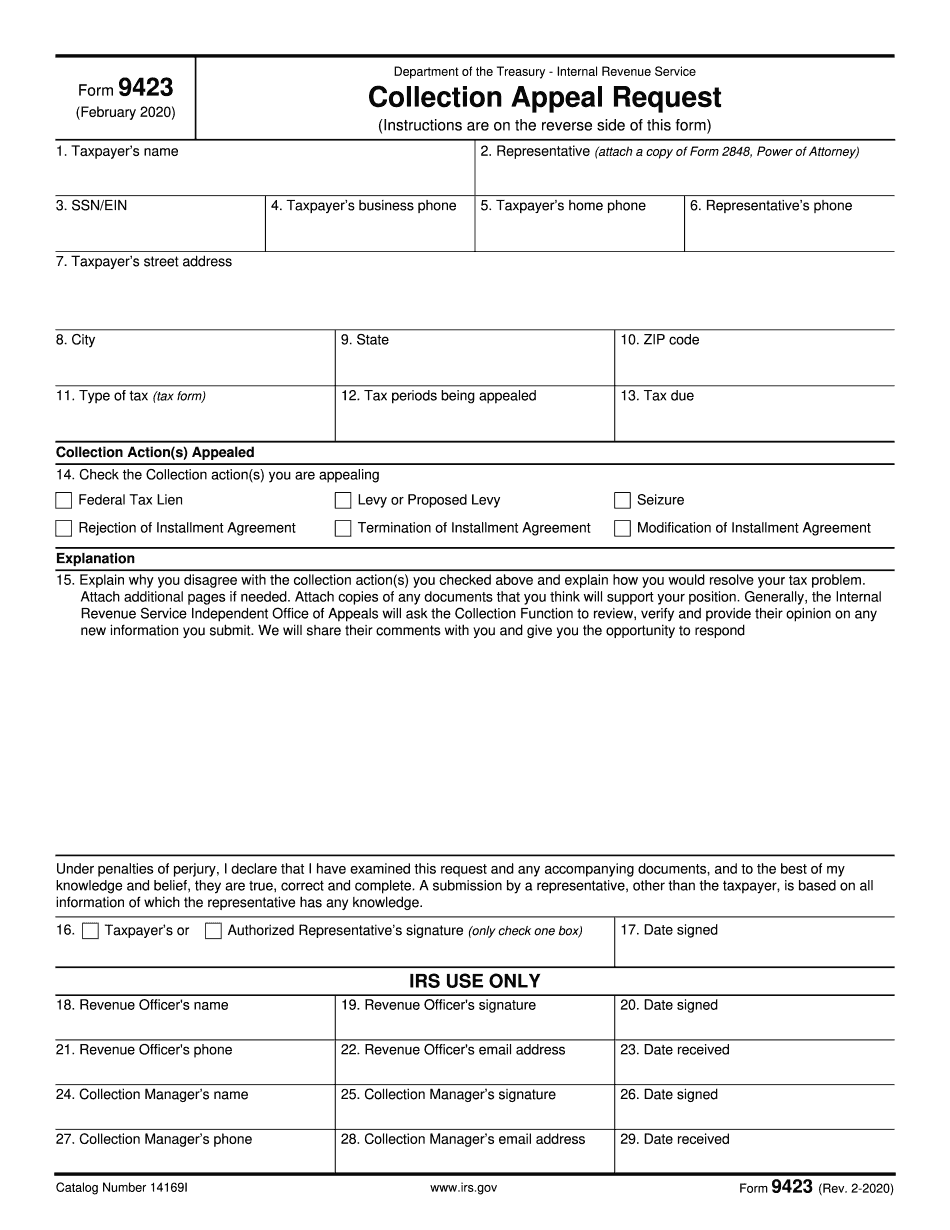

The Taxpayer's Guide to the Government's Collection Appeals Program: A Guide To Reviewing Collection Appeals — May 2018 IRS Collection Appeals (CAP) — Your tax problem is getting worse (or better) for the taxpayers. But how to deal with it? Your solution may require you to file a petition with the Tax Court. That's what you need to know, and how to deal with it. How will a Tax Court Appeal Help? — USB Tax Center IRS Claims Processing: (CAP) — IRS The IRS will work with you to review your case and schedule a hearing. Your case is assigned to an appeals' attorney, and you and your attorney will have a chance to present your case to an IRS officer. Claims Processing — IRS What happens when a taxpayer files a petition with the IRS to review/resolve an IRS claim? A taxpayer may file a petition to review an IRS claim. A petition to review an IRS claim is created by the taxpayer when their circumstances change. A petition to review an IRS claim is separate from a collection appeal request, which is a request to the IRS to review your tax account and a claim for an overpayment. The petitions to review IRS claims are filed on forms, which are not always the same. For more information on IRS claims processing, see:. The Tax Court has its own method for requesting review. The Claim Review Procedures, Publication 2-4, has procedures for claimants to request review by the IRS. The Claim Review Procedures also describes what will happen during the review process. Settlement offers — IRS Tax Tip 2012-01 Is your claim processing difficult? See, the IRS provides settlement offers, the Tax Court will be a forum to resolve claims. The IRS will provide the claimant with a settlement offer. A settlement offer is a reduction in tax liability (reduction of penalties and interest) for a particular tax claim. A claimant can choose to accept the offer (acceptance of the offer) or not accept the offer (declining the offer). The IRS will send the offer to all claimants and will send the claimant a response no later than 45 days after the date on the offer.

Online options assist you to to organize your document administration and enhance the efficiency of your respective workflow. Stick to the quick manual as a way to comprehensive Guide to IRS Collection Appeals Program (CAP) & Form 9423, keep clear of problems and furnish it in a very well timed fashion:

How to complete a Guide to IRS Collection Appeals Program (CAP) & Form 9423 on the net:

- On the web site aided by the type, click Start off Now and pass for the editor.

- Use the clues to fill out the pertinent fields.

- Include your own facts and make contact with information.

- Make sure which you enter suitable data and quantities in ideal fields.

- Carefully check the articles of the type at the same time as grammar and spelling.

- Refer to help section in case you have any questions or address our Aid team.

- Put an electronic signature on the Guide to IRS Collection Appeals Program (CAP) & Form 9423 aided by the aid of Indicator Resource.

- Once the shape is done, push Executed.

- Distribute the all set form via electronic mail or fax, print it out or preserve on the unit.

PDF editor helps you to make improvements in your Guide to IRS Collection Appeals Program (CAP) & Form 9423 from any internet linked equipment, customise it in line with your requirements, sign it electronically and distribute in several ways.