Award-winning PDF software

Irs Collection Appeals Program (Cap) & Form 9423 - Taxcure: What You Should Know

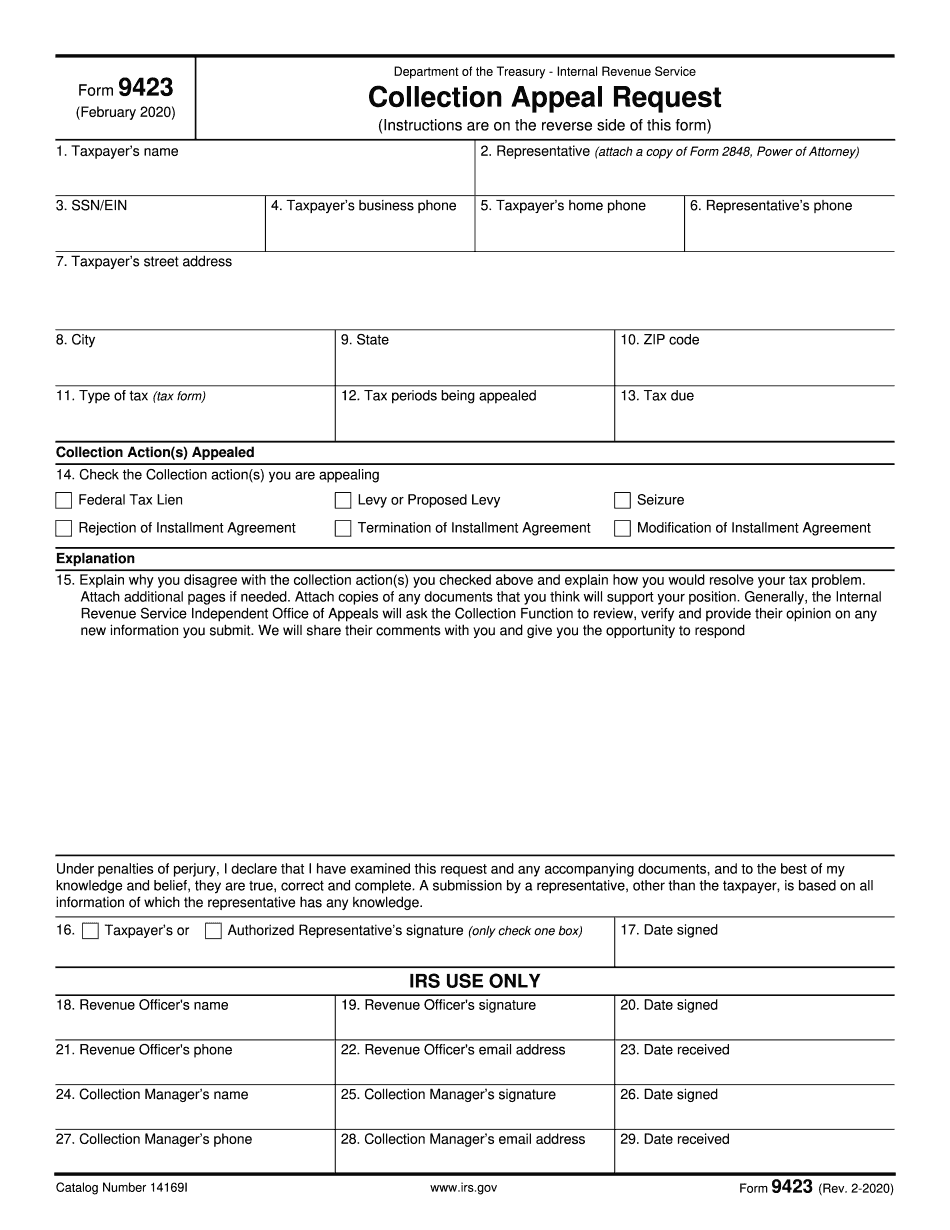

Form 9423 is not required, nor is the accompanying transcript, if one is submitted; all oral or written documents need to be submitted in accordance with the requirements listed below. If a decision on any written matter filed with a Collector prior to the date provided in a collection determination letter requires a decision on an oral matter, the oral opinion will be submitted to the Collection Appeals Officer only if the appeal is not filed electronically. Fee for filing and supporting materials is 15 plus an additional cost for each page of supporting material Request for a Review of a Tax Dispute — PDF Form 9501 — Supplemental Taxpayer Information Instruct or download the form to obtain a copy of your Notice from the IRS or your tax transcript from Form 944 (e-file). The notice portion of the form is required to show the date a question or question arose in your tax return and a list of those questions. Attach Form 9501 and the supporting documentary evidence to Form 9423 as part of your appeal. Note: The IRS may determine you do not qualify for the CAP and, without the written notice of that determination, will automatically impose and assess the Jeopardy Levy. 8.22.1 Form 3921, Jeopardy Levy Appeals Letter Instruct or download the form to obtain a copy of your Jeopardy Levy Appeal Letter. 8.22.1.6 Schedule F — CAP Appeals (for collection, jeopardy, and appeals regarding penalty and interest) A notice advising about or containing information about how to file the required form with Collection and Jeopardy Levy Appeals will be provided prior to, during, and after the Jeopardy Levy appeal. 8.22.1.6.1 A collection or jeopardy levy appeal must include the following: (1) The time when the Jeopardy Levy was imposed and the date the Jeopardy Levy was paid; (2) a list of tax questions and the dates, the answers to those tax questions, and the basis for the conclusions; (3) a list of issues raised by you or another party and the responses to those issues; and (4) any other information necessary to determine which question merits the Jeopardy Levy appeal or your ability to seek reconsideration. 8.22.1.6.2 A Jeopardy Levy appeal must be submitted before or within 20 days following final determination of the collection levy or jeopardy levy.

Online choices enable you to to arrange your document management and supercharge the productivity of your respective workflow. Observe the quick guidebook in an effort to carry out IRS Collection Appeals Program (CAP) & Form 9423 - TaxCure, steer clear of faults and furnish it within a timely method:

How to accomplish a IRS Collection Appeals Program (CAP) & Form 9423 - TaxCure internet:

- On the web site with all the variety, click Start Now and move towards the editor.

- Use the clues to fill out the relevant fields.

- Include your individual info and get in touch with data.

- Make sure that you enter right information and facts and quantities in applicable fields.

- Carefully take a look at the written content from the form too as grammar and spelling.

- Refer to help you section if you have any concerns or handle our Service crew.

- Put an digital signature on your own IRS Collection Appeals Program (CAP) & Form 9423 - TaxCure using the enable of Signal Resource.

- Once the shape is finished, press Done.

- Distribute the ready variety by means of e mail or fax, print it out or help save on the unit.

PDF editor lets you to make changes for your IRS Collection Appeals Program (CAP) & Form 9423 - TaxCure from any online linked unit, customise it in keeping with your requirements, sign it electronically and distribute in several methods.