Award-winning PDF software

Irs appeals process time Form: What You Should Know

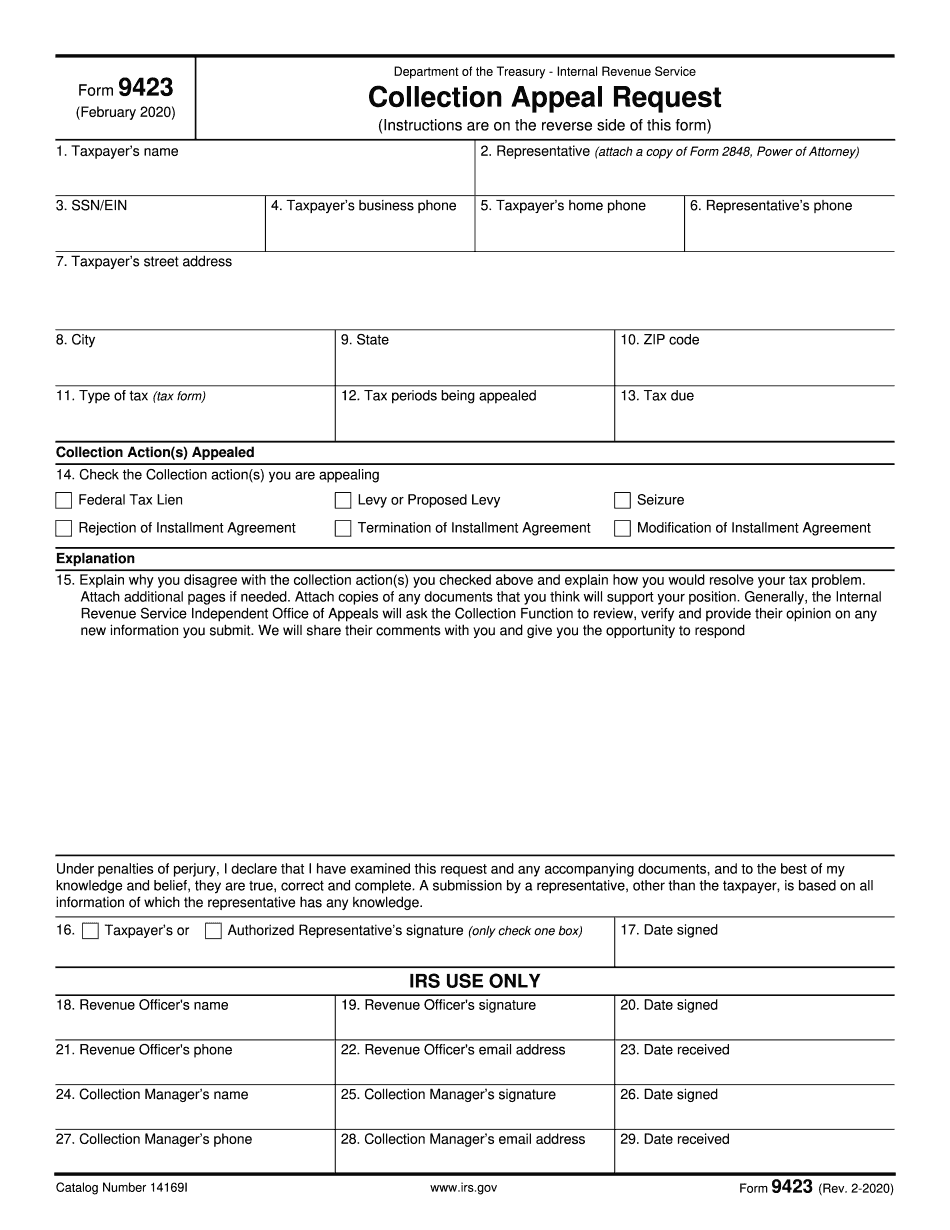

Use This Form To Request Ex Parte Conference | Internal Revenue Service Reasons to make a request to be reviewed as an independent, non-judicial, appeal examiner | Internal Revenue Service If you do not qualify for an ex parte conference or a request through IR-4227, you may also want to discuss your situation with your local Internal Revenue Service District Office. Preparing Form 9423 | Internal Revenue Service If you have already begun an appeal of the decision you were required to pay with the agency, you may wish to send the forms electronically to the agency. The IRS website maintains the addresses that have access to forms sent electronically. If you are a small business or self-employed taxpayer, you may want to contact your account supervisor to determine if your account manager has sent you forms for automatic processing. When you send your form electronically to the agency: You should receive notification that your appeal has been received and your case has not been closed. For example, you might receive an e-mail stating that you have been notified that certain income may be subject to estate or tax withholding, or a notice that your income tax return was reviewed due to nonpayment of income taxes. You should also Receive a notice from the IRS telling you that a decision has been made in your appeal. 4-2020) Appeals of Internal Revenue Service rules and regulations are a means by which the Internal Revenue Service (IRS) reviews decisions it has made in certain situations and makes them official. However, each appeals office does this process in its own way and is governed by its own rules. Use Tax Information Retrieval Tool (TRIP) to check information in your files before sending appeal forms to appeal offices The Appeals Process | Internal Revenue Service When the IRS issues an order, it means that the IRS has decided what you owe and what type of refund you owe. However, as with any court decision, the IRS can rescind the order at any time. The IRS makes every effort to ensure a fair review of certain appeals. If your case receives unfavorable treatment, it will often be reviewed to determine why it was denied. There are two types of decisions the IRS can rescind: a. Exclusion/Exclusion Order A Exclusion Order (see Internal Revenue Manual 6.50.1 — Exclusion from gross income under section 1241) will not affect a Taxpayer's right to file and receive a refund due to an IRS deficiency determination.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 9423, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 9423 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 9423 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 9423 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.